CLIENT PAYMENT REMINDERS

Get paid on time,

Send sleek, branded invoices with automatic payment reminders built in—so you can get paid without the chase.

Make paying you

Connect payments to the rest of your business.

Payment reminders FAQs

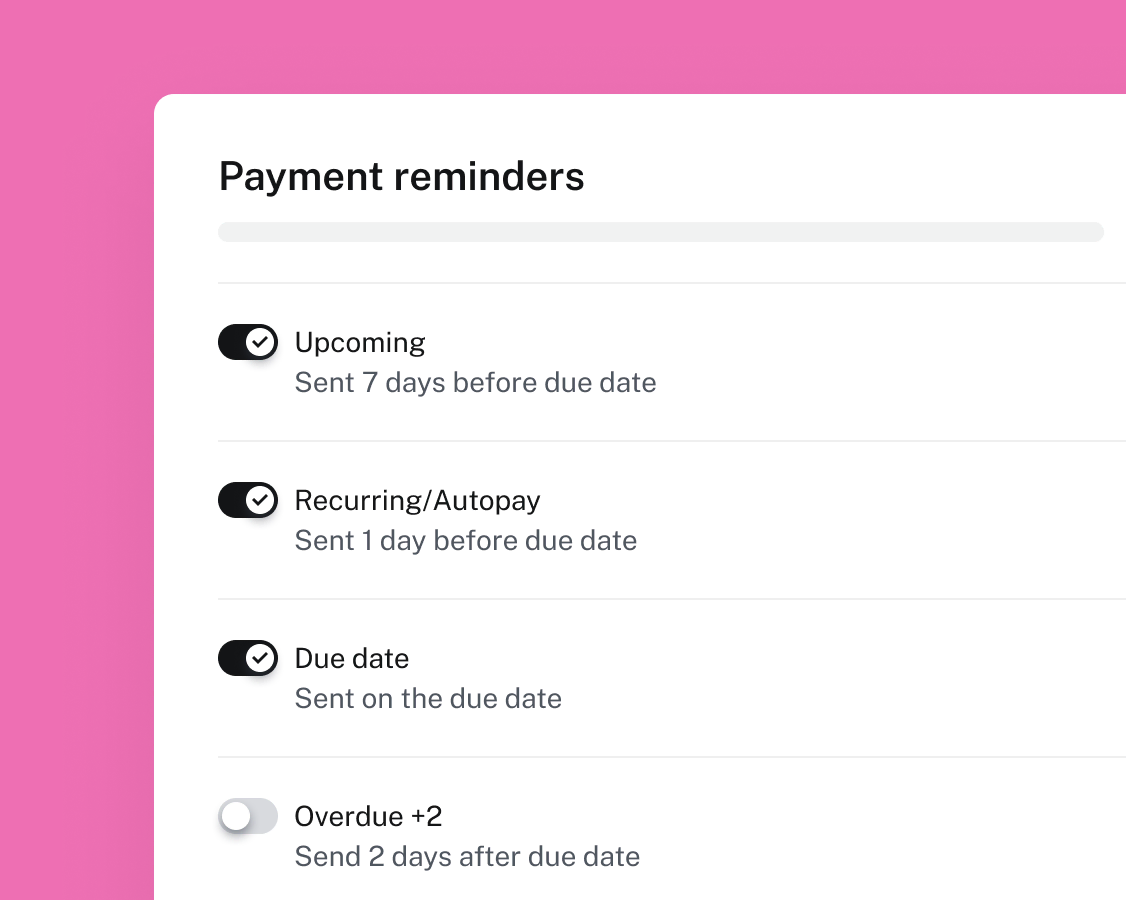

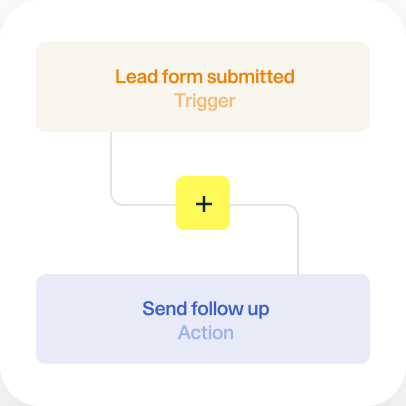

Payment reminders are automated emails that are sent to your clients to notify them of upcoming or overdue invoice payments. This allows you to remind your clients to pay you without having to send any emails yourself. With HoneyBook, you can send payment reminders 7 days before payment is due, on the date the payment is due, and 2 days after payment is due—or any combination of these three options. You can also edit the text of each email so that they match your brand voice.

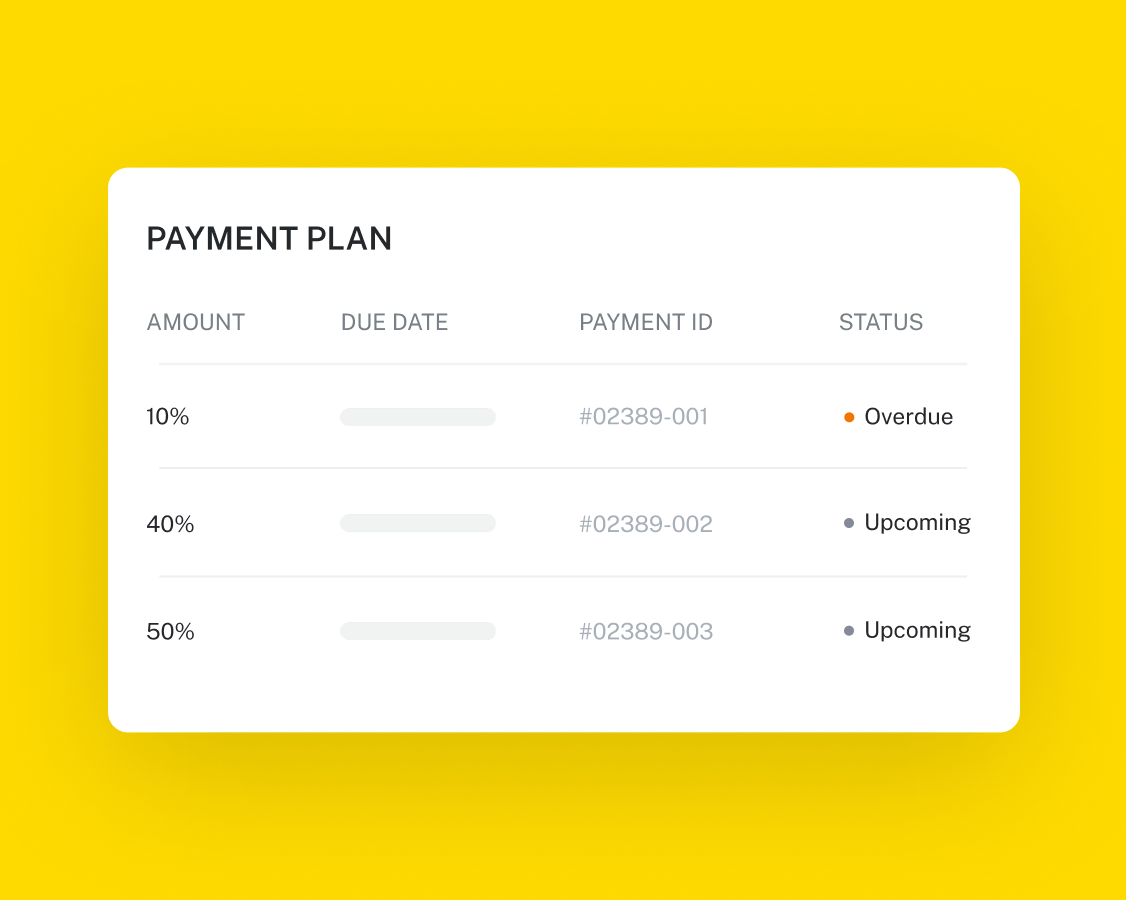

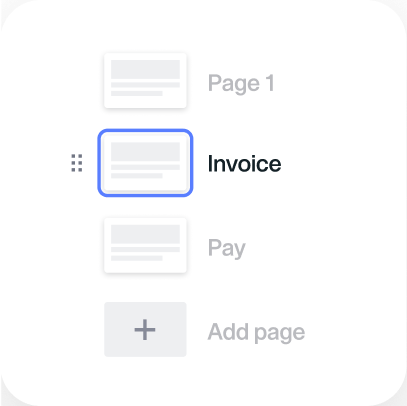

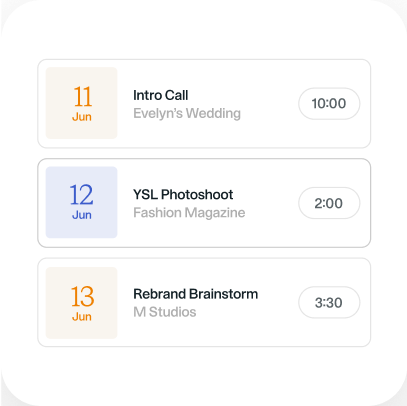

Unlike other tools, HoneyBook is an all-in-one client management system that lets you organize everything in one place. Your payment reminders live in the same tool as your client communication, project files, status updates, invoicing, proposals, and more. This makes it easy to check on your payment status at a glance as you work on the project.

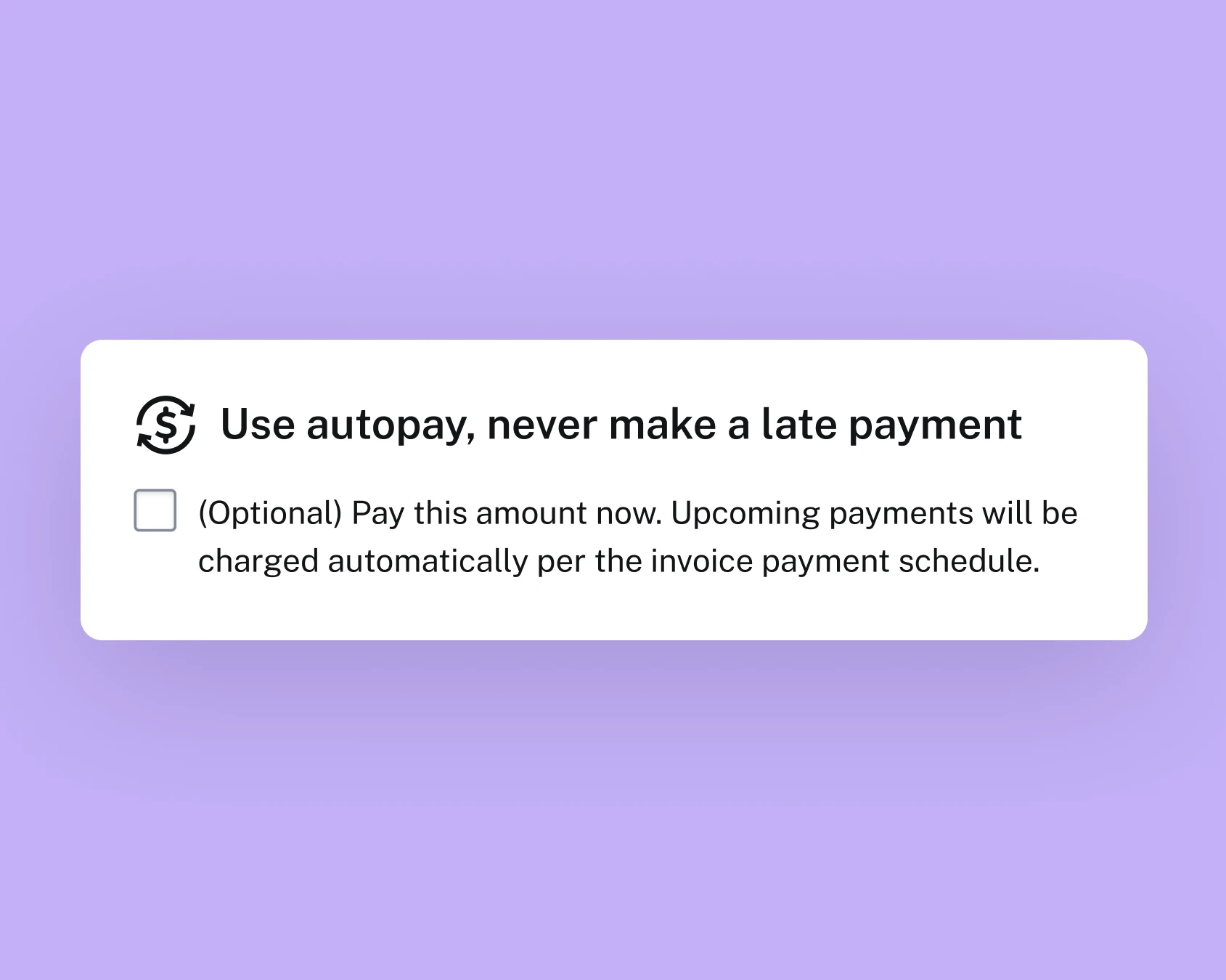

Yes! HoneyBook allows you to set up automatic payment reminders in under a minute. HoneyBook has four automatic payment reminders that are turned on by default. There are four automated payment reminders that can be turned on or off: 7 days before a payment is due, the day a payment is due, 2 days after the payment is due, and recurring payment/auto-pay reminders. For each of these reminders, you can customize the messaging of the email that’s sent to your client.

Here are some best practices you can follow for writing a good reminder email:

- Use a clear subject line that includes “Payment Reminder”

- Keep the email copy short, clear, and friendly

- Start with the client’s name and a polite introduction

- Make the payment terms clear

- Include details on how to pay or a link to make an online payment

- Attach the invoice

- Automate your payment reminders on a regular schedule

Yes, HoneyBook offers a mobile app that allows you to manage your business on the go. With the app, you can send invoices, accept payments, manage client communications, update projects, organize your calendar, upload photos, and more. For more details, please see our mobile app features.