Learn how to use proper bookkeeping for your business so you can take care of accounting, taxes, financial planning, and more.

Have you been thinking about how to streamline bookkeeping for your business? Maybe it’s a brand new year and you’re ready to meet new financial goals. Maybe you’re preparing for DIY tax filing and you realize your books could be much more organized.

Whatever you’ve decided, proper bookkeeping is key for your taxes, future planning, business financial health, and much more. Learning how to do proper bookkeeping is also essential whether you’re trying to do it on your own or looking to hire a professional. Either way, you need to understand the basics of keeping your books and how to stay organized in the long term.

What goes into bookkeeping for small business owners?

Before we dive in, let’s take it back to basics. Regardless of where you are in your business journey, it can be confusing to understand the difference between accounting and bookkeeping, and what all goes into business finances.

While bookkeeping refers to the actual record-keeping of your finances, while accounting is the analysis of your records to make decisions about investments, pricing, tax filing, and more. While a bookkeer’s primary job is to record transactions, an accountant creates financial statements and financial reports using the information recorded.

Assets, liabilities, and equity

Within bookkeeping, you’ll need to track your assets, liabilities and equity. Here’s a brief description of what each means and how you’ll use them for your business:

- Assets – Anything that your business owns with a value attached to it. This includes your accounts receivable (expected client payments), cash, and business property.

- Liabilities – These include anything you know, such as accounts payable (money due to vendors or contractors), loans, and salaries.

- Equity – Equity is simply your assets minus your liabilities, which gives you your business’s net worth.

With proper bookkeeping, you’ll continually track each of these categories to have a better picture of your business’s financial transactions, activity, and health.

Income statements

Another key part of bookkeeping is creating your income statements (also known as profit and loss), through which you’ll track your revenue, expenses, and costs. Here are a couple more definitions to help you understand what goes into each income statement:

- Revenue – Your total amount of income

- Expenses – Anything intentionally spent to help generate revenue (salaries, marketing, office, rent, etc.)

- Profit – Revenue minus expenses and other debits

- Loss – Any other debits not associated with typical day-to-day business management (settlements, asset sales, etc.)

Getting set up for proper bookkeeping

To get started with your bookkeeping, you first need to make sure that you are tracking all money coming in and out of your business. We recommend getting started at the beginning of the year, but you can always start organizing at any point.

Find an accounting software that you can use to categorize all your income and expenses. With one like Quickbooks, you can connect all your business bank accounts and credit cards, which then automatically pull transactions from your bank feed into the system.

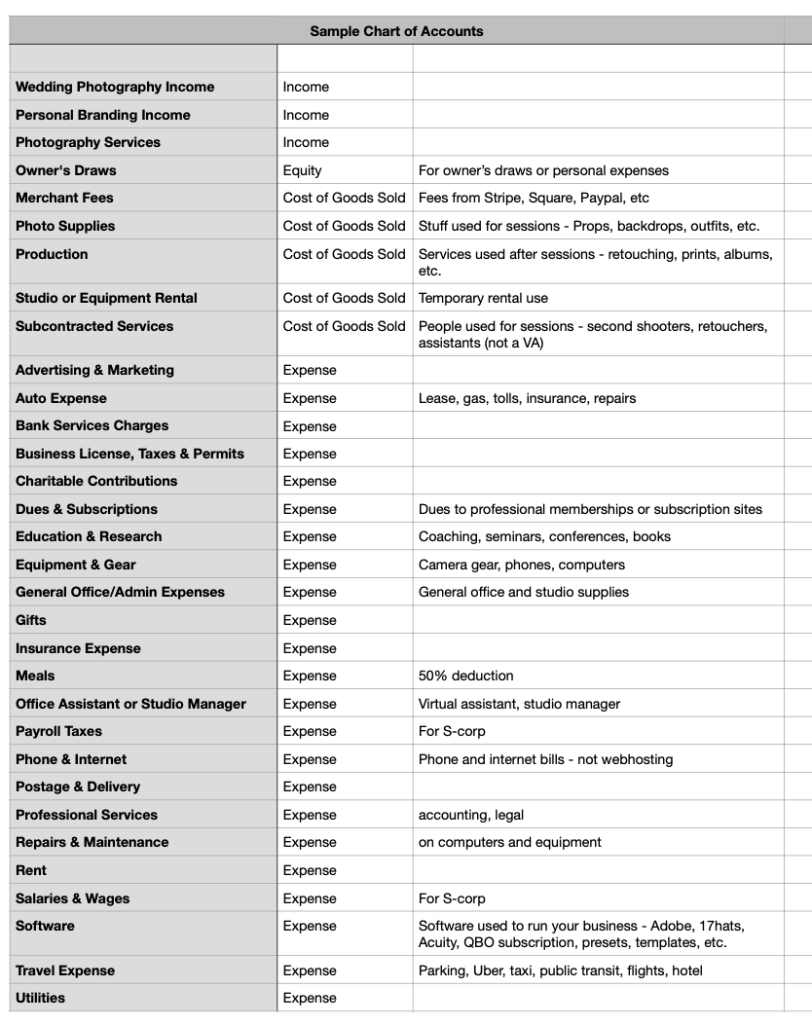

When you set up your accounting software, a Chart of Accounts is created. This is basically a system for organizing your accounts and classifying your transactions. When you have a Chart of Accounts set up properly, it will be easy to put your transactions into the correct categories. Print out a cheat sheet for yourself to make sure you are consistently choosing the same categories. See the example below of a sample photography Chart of Accounts.

Within Quickbooks, your Chart of Accounts will map income, expenses, equity, and cost of goods sold. Within HoneyBook, you can use more specific categories to track your expenses and make sure everything is accounted for.

Day-to-day bookkeeping

As soon as you’ve set up your bookkeeping software, start tracking your debits and credits routinely.

Hopefully, any business-related income and expenses flow through your business bank and credit card accounts. If there are any business purchases made from your personal accounts, you will want to make sure these are manually entered into your records.

After you’ve finished the first month of bookkeeping, you will reconcile all of your accounts. This is a very important step that many people miss. Reconciliation (think old school checkbooks) will ensure that your books are accurate and catch errors such as duplicate entries or missing transactions. In Quickbooks Online, you can use the reconciliation tool to easily compare what is in the system to your bank or credit card statements.

Categorize and reconcile month by month until you are all caught up to date. You can see the fruit of your labors by pulling a Profit and Loss Statement and Balance Sheet to make sure everything is categorized properly.

If you don’t have accounting software set up yet, you can always start with a good old Excel spreadsheet. Enter transaction details on each line: Date, amount, vendor, description, and category. You can refer to the sample chart of accounts for category options. Once you have the data entered, start a new tab with the totals for each category. These totals are the numbers you will use for tax forms.

Try HoneyBook For Free!

Integrate with Quickbooks and track your client communication, payments, expenses and more all in once place.

Start free trialMake bookkeeping a monthly habit

Once you’re caught up to date, make it a habit at the end of each month to categorize and reconcile the previous month’s transactions. Not only will you be current with your bookkeeping, but you’ll be able to make informed decisions about spending, cash flow, and revenue goals.

Your accounting software has many features that can automate and speed up the process. Just make sure you know how to use these features properly, as they can cause a mess if used incorrectly.

Which software should I use for small business bookkeeping?

Quickbooks Online is a go-to accounting software to streamline bookkeeping for your business that most CPAs will already be using. It will connect with your bank feed and has automations that will help in your workflow. There is a bit of a learning curve, but it’s a great option for businesses who want their books to be as professional as their business.

Another great feature of Quickbooks is that they integrate nicely with HoneyBook and other client management software for small businesses. Their integration will automatically import online invoices and payments into Quickbooks, and make it easy to match with your bank feed.

A test of organized books

What would you do if your accountant asked you today for a Profit and Loss Statement or Balance Sheet? Would you panic?

If you can confidently download those reports and send them off, congratulations. If, like many Independent business owners, you would start sweating and stalling, then take a good look at your current system.

Try pulling your Profit and Loss Statement and Balance Sheet. Are they simple and well-organized? Are you able to clearly understand your revenue and profit margin for each month and year-to-date? If not, it’s time to do some research and/or call a professional.

Tax compliance is the goal of organized books is first of all. The IRS wants an accurate record of the money coming in and out of your business each year.

The next goal when you streamline bookkeeping for your business is learning from your numbers so that you can truly grow and scale your business. Making proactive, strategic decisions is key to a healthy business. It could be that messy books are holding you back from increased profit and growth.

It may take some time to declutter and freshen up your financial records. Sometimes it gets worse before it gets better. But on the other side of the mess are up-to-date, 100% accurate records. And with those, you will be able to analyze, strategize, scale, and increase earning potential. You’ll be empowered to reach your goals and grow your business.

Hire a bookkeeper

By now, you should be more acquainted with proper bookkeeping practices. But, that doesn’t mean it has to be all your responsibility. Bookkeeping and accounting are complicated business practices that need to be done correctly, so it’s always a good idea to hire a bookkeeper if you can.

Consider working with a HoneyBook Pro who can dive into your business quickly, understand your future goals, and help you get financially organized.

Work with a professional accountant!

Browse HoneyBook Pro accountants to find the professional who will organize and manage your books.

Find a Pro