Though Venmo was one of the first apps that allowed you to accept payments on your phone, there are several reasons why you shouldn’t use Venmo for business transactions. Learn why you should use a clientflow platform with payment processing instead.

For many years, Venmo was many independents’ go-to for taking payment in exchange for services. This was because it was one of the only smartphone-based options, which is no longer true. Many apps exist that allow you to bill for your services. You might be wondering why the app you use to receive payment matters—getting paid is getting paid, right?

Not quite. How you are collecting payments can bolster your earnings or lose you money to high transaction fees, deficient security measures, poor professionalism, and a complicated process. Not to mention using the wrong payment processing app can choke your cash flow, leaving you with less money to reinvest and grow your business.

There are a few reasons to be choosy about the platform you use for collecting payments. Here we dive into why using Venmo to process business payments can lose you money, clients, and growth opportunities. We also cover why an all-in-one clientflow solution can help you save money, keep clients, and set you up for growth.

Jump to:

- What is a payment processing software?

- Why using Venmo for business payments is unprofessional

- 7 reasons why you should stop using Venmo for business transactions

- New charges to look out for

- Simplify client interactions and streamline payment processing

Process client payments quickly and securely with some of the lowest fees in the industry.

What is payment processing software?

Payment processing software enables independent business owners to accept electronic payments from clients. With a good payment processing software, clients can pay an invoice from their desktop, laptop, tablet, or smartphone, often at the click of a button.

The best payment processors safeguard personal information like your name and your client’s name with encryption. Some examples of payment processing platforms include HoneyBook, Clover, PayPal, and Venmo. HoneyBook is technically more than a payment processing platform, but more on that later.

Why using Venmo for business payments is unprofessional

Whether you’re just starting or you’re operating an established independent business, it’s possible you’ve received or sent a payment through Venmo. Many of us have; I’ve taken payments for bartending catering services through Venmo myself way back in the day. There are very, very good reasons why I no longer do, and one of them boils down to a story.

A caterer’s experience using Venmo for business

I was thrilled when a referral contacted me to use my bartending services at a wedding in a historic hotel. The day came and the event ran smoothly, up until payment was due. I emailed the invoice to my client and offered Venmo, check, or cash as payment options (I know, I know—I needed a more streamlined clientflow).

When payment day arrived, the client sent payment—to the wrong Venmo account. After many painstaking emails back and forth, several hours spent with Venmo’s support team, and talking to the account holder who received the money, he was able to send me the payment for my services.

Not exactly great customer support. It was quite apparent that Venmo was deficient in offering what other established business payment platforms offer: more robust buyer protection and dispute resolution services.

Lesson learned. Those are hours my client will never get back in their day, and I’m not just talking about hours spent with Venmo support. I’m talking about the hours we spent emailing back and forth, and on the phone, and on apps, to accomplish something that should be an error-free, simple process: Securely send an invoice and offer click to pay. Sounds much more professional, am I right?

Related Post

How does payment processing work?

7 reasons why you should stop using Venmo for business transactions

If my story didn’t give you pause, that’s okay. There are a few more reasons why you should be wary of offering Venmo as a way to accept online payments for your professional services. Venmo for business requires so many steps to get paid, and we just can’t imagine you having to go through that.

1. Venmo invoices don’t—and can’t—represent your brand

Can Venmo hurt your brand? If you’ve ever sent money using Venmo, you’re familiar with its hallmark look: the blue accents, the gray and white background. Well that’s what your clients see too, when you request payment through the app. Instead of a professional invoice that explicitly reflects your brand, you’re promoting Venmo’s.

When you consider how hard you’re working to build a consistent brand identity, this inconsistency can be a real problem. Venmo, primarily a peer-to-peer payment platform, might not convey the professionalism of more established business solutions. This, in turn, could impact how clients and partners perceive your brand. Over time, relying solely on Venmo may hinder your ability to reach a broader customer base.

2. Venmo for Business doesn’t offer flexible payment options

Point blank: Venmo for Business requires your client to use Venmo. You send an invoice with Venmo for Business, and the client has to sign up for Venmo (if you want to take advantage of low fees). If your client pays with a credit card instead of the app, the payment fees more than double from 1.9% + $0.10 to 3.49% + $0.49.

Consider your clients. Are all of them tech-savvy? To make your process as user-friendly as possible, you should offer tools that everyone can use.

If your client doesn’t use Venmo and you require it for payments, you may lose them before you get the chance to complete the booking process. Venmo simply isn’t a universally satisfactory option.

Pro tip

HoneyBook’s low payment fees and secure payment platform give you and your client the most versatile payment options while ensuring you have some of the lowest fees in the industry.

3. Inflexible transaction fee structure

Every online payment platform has transaction fees, but there are plenty that have less-than-desirable fee structures.

At first, Venmo payment fees for business look appealing at 1.9% + $0.10 per transaction, but the hidden cost is in the types of payments. These low transaction fees only apply to purchases made within the Venmo app or using the QR code.

Your clients should be able to pay however they want without it coming back on you financially. HoneyBook’s payment processing fees are designed to compete with major credit card processing apps like PayPal.

And they do: HoneyBook’s credit card processing for entered payments is 0.09% + $0.24 less than PayPal’s credit card processing fee. Here’s a breakdown of all HoneyBook’s transaction fees:

| Cardholder Entered | Card on File | ACH Payments (received from clients) | Instant Deposit (optional service for transfer of received funds) |

| 2.9% + 25¢ | 3.4% + 9¢ | 1.5% | Additional 1% |

HoneyBook integrates payment processing directly into its platform, allowing clients to pay invoices online without needing a separate payment integration. This streamlined approach saves business owners time.

And then, there’s Venmo: while that 1.9% + $0.10 looks appealing, remember it’s only for Venmo to Venmo transactions, and Venmo isn’t a preferred payment method for clients. The fee for the preferred transaction method, credit cards, shoots up to 3.49% + $0.49—that’s 0.59% + $0.24 higher than a one-time credit card charge using HoneyBook’s payment platform and 0.09% + $0.40 more than HoneyBook’s card on file fee for autopay.

And remember that after you receive a payment through Venmo, you have to manually transfer it to your bank account in batches, too.

4. Your money doesn’t go directly into your bank account

Once you get paid on Venmo, the payments don’t go directly into your bank account. Strange, right? You have to go in and manually transfer money out of your account, making for a cash flow nightmare.

Pro tip

Cash flow is the total cash minus expenses flowing into and out of your account at any point in time. If you’re spending more money than you have on hand, you’ll have a negative cash flow.

If you have a business credit or debit card separate from your Venmo account that you use for business purchases, transferring cash from Venmo to your business bank account adds one more step when you need to access your money.

Furthermore, instant transfers cost 1.75% of the amount transferred with a minimum of $0.25. Fee-less transfers can take one to three business days.

Not only that but there’s a $5,000 cap per transfer. That means if your client paid you $6,000 for your services, you have to manually transfer $5,000, then manually transfer $1,000, then wait for up to three days to receive your hard-earned cash. Also, this is only if you’ve verified your identity. If you haven’t, you can only transfer $999.99.

5. Figuring sales tax in Venmo isn’t automatic

It’s not possible to include sales tax for payments sent directly to your business profile by another Venmo user. Venmo doesn’t auto-calculate sales tax for services or goods, so you have to check those tax rates every time you charge a client.

6. Venmo lacks the features essential to help manage your business

The biggest objection many users have to Venmo for Business is that it doesn’t integrate with popular accounting software and other apps that most service providers need to run their daily operations. The idea of app-jumping is annoying. Lack of integration, along with the absence of detailed transaction reporting, can complicate bookkeeping and financial management, which are crucial for managing a business efficiently.

7. Scalability concerns

As your business grows, you may find that Venmo’s features and limitations do not scale well with increased transaction volumes and more complex financial needs. Investing in a more robust payment solution early on can save time and resources in the long run.

New charges to look out for

As of July 2024, if you “receive payments in your personal Venmo account that are identified by the sender as for goods and services,” you will be charged 2.99%. (The percentage of that payment goes directly to Venmo.)

If you receive payments in your Venmo for Business account for goods and services, the seller transaction fee is less:

- 2.29% + $0.09 for Tap to Pay payments

- 1.9% + $0.10 for all other digital transaction types, including debit card, Venmo balance, or bank transaction

What’s the major downside to these seller transaction fees? They’re nonrefundable.

Venmo is testing out a sales feature that “enables you to create and share cash back rewards for customers who follow your business profile on Venmo. Customers can even get a notification when you’re running a promo, so they can snag a local deal. It also shows up in their feed.

If might seem like a great feature to get new clients, but if someone redeems your promo, you’re in for a hefty seller transaction fee:

“When a customer redeems a promo, the seller transaction fee is a standard rate of 1.9% + $0.10 of the payment total, plus a promo redemption fee of 2.9%.”

You’re being charged double the fee for trying to get new business.

Simplify client interactions and streamline payment processing with an all-in-one client flow management platform

Instead of using Venmo for business transactions, use a clientflow management platform instead. A clientflow management platform offers payment processing and so much more. Instead of using Venmo, PDF invoices, scheduling apps, and many more tools–you can have everything in one place to manage your business more efficiently.

HoneyBook is a clientflow management platform that enables independent business owners to manage the complete process of selling and delivering their services to clients. From the moment an inquiry reaches out in your contact form, you can capture them as a lead and automate a follow-up email, helping you get back to them first and making them more likely to choose your business.

If your lead is a good fit, you can easily move forward with booking by sending an invoice that includes payment processing. As soon as your client is ready to move forward, they’ll be able to view the invoice and pay in one step. You can even customize your files to include contracts so the entire booking process is taken care of in one step.

Pro tip

86% of clients hire the business that responds first.

Less hassle on both the client and independent sides and quick and easy payment collection give you more time back in your day to focus on running your business. Fast, easy payments increase your cash flow so you have the resources you need to scale.

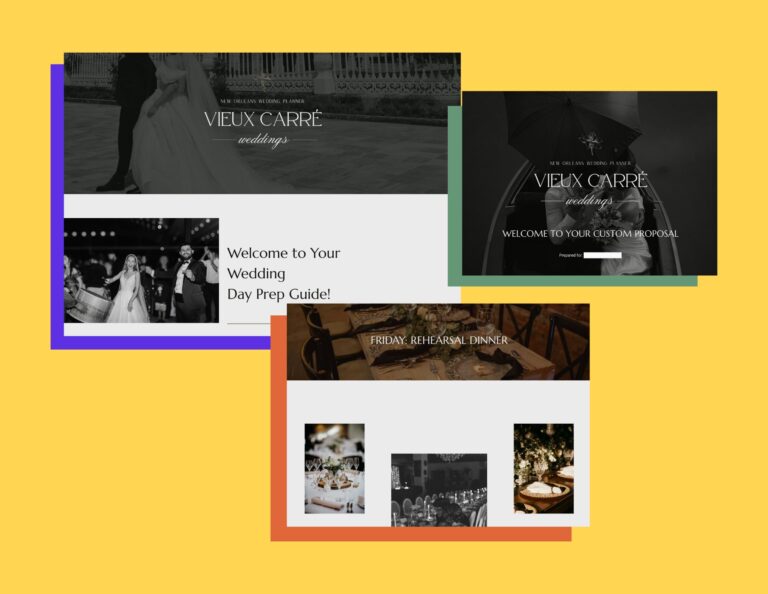

HoneyBook makes it easy to send branded invoices and take payments

We’re not just talking about the ability to add your logo. We’re talking full-blown customization. Top graphic for a header, your name, logo, and custom services. You’ve worked hard on your branding and it’s one of the many ways your clients will never forget you.

With HoneyBook’s invoice templates, you can send customized invoices straight from the HoneyBook app. Additionally, our smart files allow you to link service selection, invoicing, and payment all in the same file, automating your entire booking process so you can get to work on the deliverables.

With HoneyBook you leverage every dollar you earn for business growth

At HoneyBook, we believe in empowering independent business owners to build a life of passion and purpose. That means we prioritize getting every dollar your clients pay you into your bank account stat. We also advocate for filing your taxes and leveraging every write-off that makes sense for your independent business.

Instead, if you earned over $20,000 and processed 200 payments in one year, we send you an electronic 1099-K. That’s it. You have all your cash so you can reinvest in your business and write off new tools, and we send you what you need to report properly.

If you transacted under $20,000 in a year or processed less than 200 payments, you don’t need to be on the lookout for any paperwork from us. You’ll work with your accountant to do your own reporting, and you can download your HoneyBook analytics reports for monthly or yearly overviews of your cash flow.

Fortunately, whether you transact over $20k with 200 payments annually or not, HoneyBook’s QuickBooks integration makes tax time easy every year.

HoneyBook also offers a dedicated disputes team to assist with any and all chargebacks. We want you to get paid, and we mean that. Our disputes team is here to walk you through unethical refund requests so you keep your cash flow consistent.

Pro tip

Download the HoneyBook mobile app in the App Store or Google Play Store. You’ll also get to enjoy a delightful note every time a client pays an invoice. Cha-ching!

Get paid quickly with professional invoices and low transaction fees, every time.

HoneyBook’s clientflow management platform is specifically designed for independent business owners to manage every step of the clientflow, from onboarding to service delivery to referral. With HoneyBook, you get attorney-drafted contracts, customizable invoicing, top-notch payment processing, and project management tools all in one place.

In short, HoneyBook streamlines your business, enhances your brand, and makes getting paid easy.

Venmo originated as a peer-to-peer payment platform. It’s primarily used for sending money between individuals—splitting bills, paying friends back, and other casual transactions—but we don’t recommend it for business transactions.

Use HoneyBook to simplify your payment process—no more chasing payments.