Are you a sole proprietor? Here’s a complete guide to learn why you need a profit and loss statement for your self-employed revenue to be able to track your business growth and the finances you need for taxes at the end of the year.

A profit and loss statement (P&L statement) is one of the most important financial statements for a business that allows owners and managers to track revenue and expenses over a period of time.

With a bigger picture of finances, you can use it to make strategic decisions about where to allocate resources and understand your business expenses and business revenue. It’s typically required documentation for official purposes such as tax filing and reimbursements, but its status as a “must-do” isn’t the only thing that makes it a “must-have.”

This article explains why being a self-employed business owners such as sole proprietors is such a benefit, and also goes into the nuanced differences between what it means for independent businesses versus larger companies.

Jump to:

- Why do self-employed people need a profit and loss statement?

- What should go into a P&L statement?

- How to set up a profit and loss statement

- Easily make profit and loss statements with HoneyBook

Why do statements of profit and loss for self-employed business owners matter?

Self-employed business owners who provide one-to-one services to clients are typically not required to prepare profit and loss statements the same way publicly traded companies are. This is because private companies are not necessarily required to comply with generally accepted accounting principles (GAAP). Indeed, some smaller companies may not even prepare formal financial documents such as P&L statements at all.

Although self-employed business owners may not be legally required to prepare P&L statements, preparing them along with tracking other financial reports and key metrics can still be beneficial for many reasons.

A simple profit and loss statement for self-employed individuals can be essential for managing finances, organizing a cash flow statement, and ensuring that you’re reaching your business profit goals. profit and loss statement for small businesses can help keep track of expenses and income, budget more effectively, and make informed decisions about their future business performance.

- Income and expenses: A P&L statement can give you a clear picture of your business income, business costs, and ongoing expenses over a certain period of time, which can be helpful for tax purposes.

- Budgeting: Having a record of your actual income and expenses can also help you create a more accurate budget for your business. This, in turn, can help you make better financial adjustments going forward.

- Informed decision-making: Reviewing your P&L statement regularly can provide valuable insights into the financial health of your business. This information can be used to make informed decisions about things like pricing, marketing, expansion plans, overhead expenses, and more.

What should go into a P&L statement?

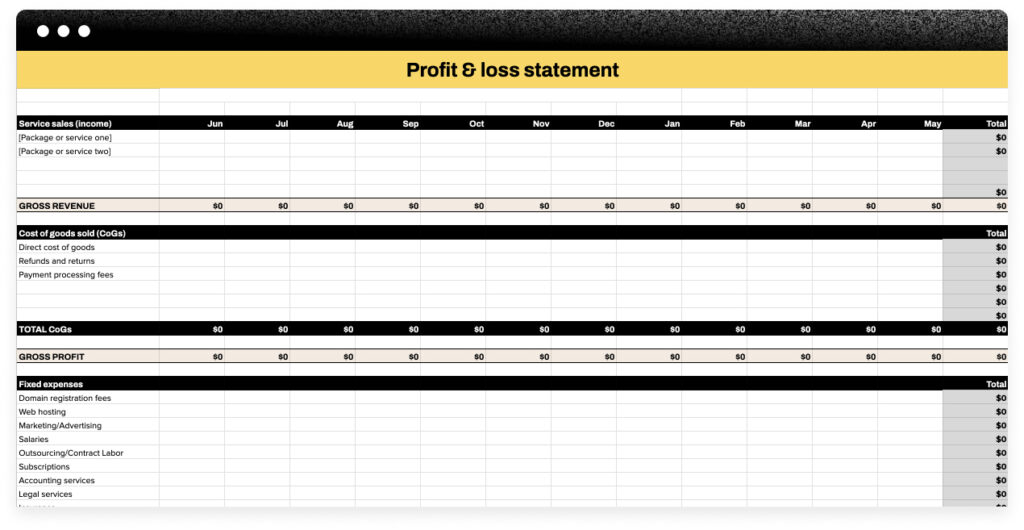

A profit and loss statement (sometimes referred to as an income statement) summarizes income and expenses for a given time period. There are common elements to include to make it useful. The most common approach is to list all revenues at the top and then all the expenses afterward. This will make your bottom line instantly pop out for the period covered.

There are, of course, some differences between how you would make a profit and loss statement versus how bigger companies with compliance requirements would do it. You probably won’t need anything more complicated than a single-step P&L, while larger companies require a multi-step P&L.

Self-employed vs. bigger companies

A single-step P&L just lists all revenues and expenses incurred during that period with net income being the difference between them. This is common for smaller businesses as it’s easier and faster to prepare since there aren’t as many categories of revenue and expenses (materials, labor, interest expense).

On the other hand, multi-step P&Ls present a more detailed picture by starting with gross profit which is computed by taking total revenue minus the cost of goods sold (COGS). From there, operating expenses are deducted, leaving you with operating income before extraordinary items + tax + interest expense = net income. This is common for larger businesses as they have more categories of revenue and expenses (research and development, marketing, management fees).

There are several key elements in a Profit & Loss Statement, including:

- Revenue: This includes all sales made by your company during the period being analyzed. It’s important to break down actual revenue by type (product vs. services) as well as account for any returns or refunds given out.

- Cost of goods sold (COGS): – Aka direct expenses. These include materials used in production and labor costs directly related to making and selling the product or service, unlike operating expenses which can’t be traced back to one specific product sale.

- Gross profit: Total revenue minus COGS. This number represents how much each sale contributes toward covering indirect and fixed expenses and ultimately turning a profit.

- Operating Expenses: Also called “Selling General & Administrative” (SG&A) expenses which include things like rent, utilities, and administrative salaries. These tend to be fixed regardless of how many products are sold.

While all this is helpful for larger businesses, your sole proprietor status needs fewer elements and less complexity. In fact, as a sole proprietor, you actually aren’t obligated to prepare a separate self employed profit and loss statement (though it’s highly recommended due to its benefits), since you’re effectively completing a year-to-date P&L statement when you complete your IRS-required Schedule C (Form 1040) as a self-employed individual.

If you do prepare a separate P&L statement for your own purposes, it’s sufficient to focus on gross and net income, as well as business expenses.

Pro tip

While looking up information for P&L statements, make sure they’re applicable to your service-based business. A lot of information out there is geared toward products instead of services.

How to set up a profit and loss statement for self employed income

You can prepare P&Ls on either an accrual basis or a cash basis.

Accrual basis

On an accrual basis, revenue is recognized when it is earned, even if the payment has not yet been received. This means if a company provides a service in December but doesn’t receive payment until January, the revenue would still be recorded in December.

Similarly, expenses are recorded when they are incurred, even if they have not yet been paid. So, if a company pays rent in advance, the expense would be recorded in the month that it was paid rather than when it was incurred (if different).

The main advantage of using an accrual basis is that it provides a more accurate picture of a company’s financial performance since all revenues and expenses are accounted for regardless of when money actually changes hands.

However, this method can be more complicated and may require businesses to keep track of accounts receivable and payable. Additionally, businesses may need to pay taxes on income before it is received (accrued), which can create cash flow issues. For these reasons, many small businesses prefer to use the cash basis instead.

Cash basis

On a cash basis, revenue is only recognized when it is received and expenses are only recorded when they are paid.

So, if a company provides a service in December but doesn’t receive payment until January, the revenue would not be recorded until January. This method is simpler than the accrual basis, as businesses only need to track actual cash inflows and outflows.

However, it can provide an inaccurate picture of a company’s financial situation since revenue may be earned but not yet received (and thus not reported), and expenses may be incurred but not yet paid (and thus also not reported).

Easily make profit and loss statements with HoneyBook

HoneyBook is a platform designed to support independent business owners. Its custom capabilities and tools automate work-intensive and manual tasks, such as tracking revenues and expenses.

HoneyBook makes it easy to create a statement of profit and loss for self employed income by automatically pulling in income information from payments and expense information from invoices created in the platform. Everything you need to generate a P&L statement is organized in one place. Manage your clientflow from start to finish and better understand your business performance. Start with HoneyBook’s free trial and see for yourself.