Receipts and invoices are essential payment documents that record the goods and services you provide. But you issue a receipt after receiving a payment and an invoice before, which changes the information each needs to include and the way you can use each one.

Maintaining a record of business transactions—purchases, returns, and exchanges—is necessary to keep finances in order, handle your business’s taxes, and monitor its performance. Clients also need transaction documentation for their financial records. This makes invoices and receipts a crucial part of your business.

These payment documents are similar, however, and it’s easy to confuse when you need to use each one. This guide will help you understand what sets apart invoices vs. receipts, like what each includes and how to use them.

Jump to:

- What’s the difference between a receipt and an invoice?

- What needs to be included on a receipt?

- What needs to be included on an invoice?

- How can clients use receipts vs invoices?

- How can a business owner use receipts vs invoices?

- Avoid the confusion between invoices and receipts

What’s the difference between a receipt and an invoice?

A sales receipt is proof of payment, confirming the client received the goods or services they paid you for, or that your business collected its payment for the goods or services you sold the client. Though you don’t legally need a receipt for all transactions, clients generally want one after making any purchase, so it’s common practice for e-commerce businesses to always provide receipts.

Pro tip

Do not confuse receipts and bills. Bills are documents you give expecting an immediate payment, while you only give a receipt after the client pays you.

An invoice, on the other hand, is a document you send to the client after providing a good or service to request payment. It tells your client what they owe you for, how to pay you, and the date they need to pay by. As a result, invoices generally have more information than a receipt.

What needs to be included on a receipt?

A standard receipt should include:

- Your business name, logo, and contact information

- The date of sale

- An itemized list of the services you sold

- The price of each service you sold

- Any discounts or coupons applied

- The total amount paid, plus fees or sales tax

Though not necessary, some receipts also include:

- Payment options

- Terms of sale

- Your return policy

The return policy in particular is a useful notice to the client, so they understand what conditions they should meet to qualify for a refund or exchange.

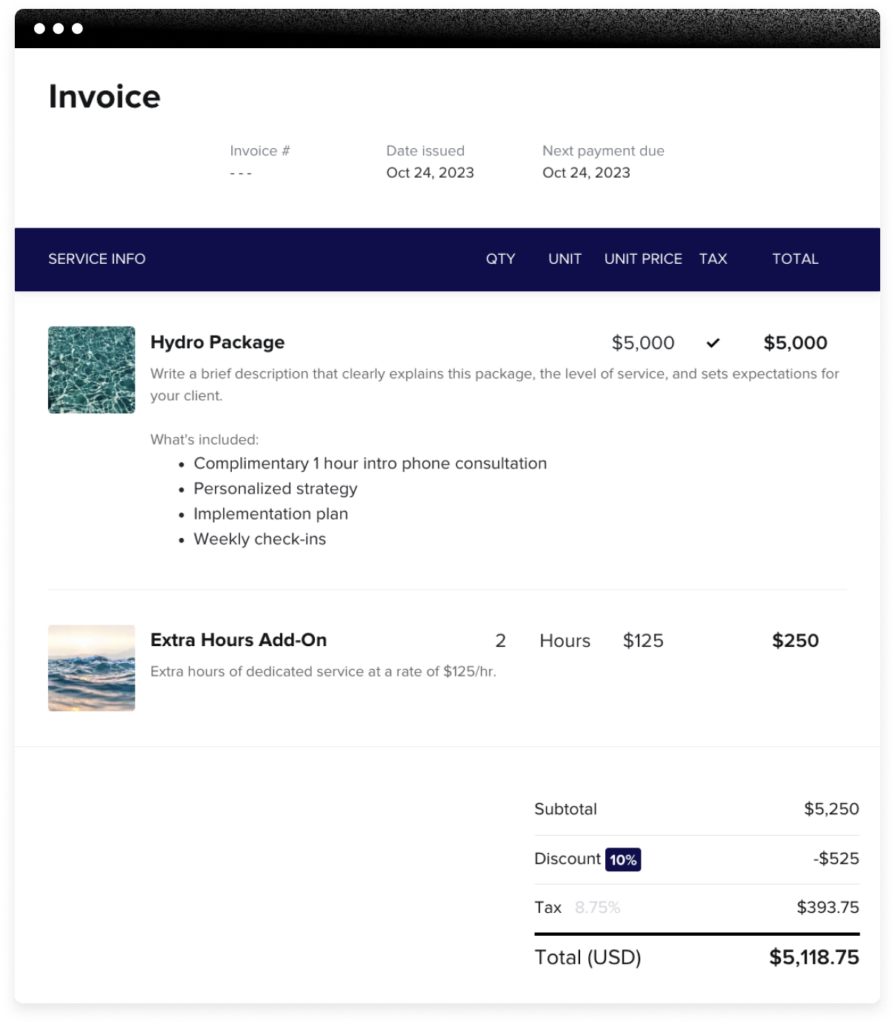

What needs to be included on an invoice?

An invoice both requests a payment and records a transaction, so it should tell the payer exactly what each charge is for and the expectations for compensation. Each invoice should include:

- Your business name, logo, and contact information

- Client name and contact information

- Unique invoice number

- Date you created the invoice

- Date the payment is due and any other payment terms

- Acceptable payment options

- Detailed description of the services the payer bought, including price and quantity

- Total amount owed, including taxes and fees

It’s common to generate invoice templates using software like the HoneyBook platform so you can fill out the necessary information to get your payment on time.

How can clients use receipts vs. invoices?

A receipt is a document that tells a client the goods or services they’ve paid for and received. They can store these for their records to track their cash flow. The receipt also includes identifiers —like date of purchase and order number—that they can provide If they have any trouble with a purchase, or if they need to show proof of ownership.

Since you issue an invoice before the client pays, however, it instead lets them know how much they owe for your goods or services and when to pay it. Clients can file invoices, like receipts, for proof of payment, but they’re also reminders of what they owe you. HoneyBook also sets up payment schedules and reminders to make sure clients pay you on time without any trouble.

How can a business owner use receipts vs. invoices

Receipts and invoices share some common uses—namely recordkeeping and taxes. Both help you track your income over the year. The IRS recommends saving both receipts and invoices as support for the entries in your books and on your tax return. If you’ve issued them to receive payments, they fall under the category of gross receipts, showing the amounts and sources of your company’s income.

The way to use each one is a bit different, though. Receipts simply help track and show proof of your revenue, whereas, since invoices include an itemized list of offerings and their corresponding prices and sales taxes, you can use them to calculate the sales taxes you have to remit to the IRS.

Pro tip

After filing for income tax returns, the IRS says you should keep your documents for three years. Keep your records for six years if income wasn’t reported when it should have and it makes up more than 25% of the gross income on your return.

Receipts also show the client actually owns the good or service you offered, since you issue them after payment, so you can refer to them in the case of a return or exchange.

Contrarily, since you issue invoices before the client pays, they offer legal proof you’ve completed your part of the transaction if you need to take legal recourse. They can also indicate what goods or services make you the most money or sell the best, and when certain services have higher demand.

Avoid the confusion between invoices and receipts

Receipts and invoices are necessary payment documents for your business but, as you can tell, there are key differences you need to get right each time to make sure they’re useful for you and your clients. But, because you need to issue one for each payment, even if you know the difference, it’s easy to mix up which one you need.

Let HoneyBook help you. It’s an all-in-one clientflow platform where you can manage your entire business in one place. The platform’s invoice templates combine any actions you need, like contract signing, payment processing, and scheduling.

Within the HoneyBook platform, you can also capture leads, view all your client communication, automate workflows, and view your payment data.

Create professional and branded invoices in minutes with HoneyBook.