Discover how to create an invoice that looks professional and gets you paid fast. Follow this step-by-step guide to create an easy-to-follow invoicing process for your small business.

Mastering the art of how to create an invoice is a pivotal step for small business owners. Initially, the prospect might seem a bit tedious, but don’t worry. Creating an invoice is a straightforward process that takes just a few minutes to understand. Moreover, it’s reassuring to know that you can test your skills by sending an invoice to yourself, ensuring that everything aligns seamlessly.

One of the keys to success is utilizing invoice templates to craft professional invoices. In this guide, you’ll walk through the invoicing process, and explore how to design professional-looking invoices.

Jump to:

- What is an invoice?

- Why do I need to create an invoice?

- Creating your invoice step-by-step

- How to format your invoices

- How to send an invoice

- Level up your business and get paid faster

The Importance of Creating Invoices

If you’re an independent business owner, you will need to make invoices. An invoice is what a business sends to a client to request payment in exchange for services, functioning much like any other bill, such as for utilities or at a restaurant. The term “invoice” is commonly used by service-based businesses and independent contractors.

Is it hard to create invoices? No, creating invoices is not hard, especially when using HoneyBook. HoneyBook’s online invoicing software makes the process straightforward, allowing you to create professional invoices in minutes. Simply input the necessary information, and the software will generate the invoice for you.

When creating a professional invoice, particularly through online tools, is essential for independent business owners as it will help you:

- Establish yourself as a professional service

- Create a document that ensures easier financial record-keeping

- Make it easier to keep track of invoice payments and allow your clients to do the same

- Establish a payment schedule

- Provide clients with documentation of what services they’re paying for

Invoicing clients helps you build trust with your current and future clients. Trust is crucial for maintaining long-term clients and is essential for positive customer relationships.

Customize, download, and send a professional custom invoice in minutes.

Creating your invoice step-by-step

The easiest way to create an invoice is to use HoneyBooks online invoice templates with smart fields that can auto-populate your client’s information. HoneyBook offers a variety of invoice template options for different types of independent businesses, making it simple to replace and customize your invoice no matter your industry.

Next, we will review step-by-step how to create an invoice, ensuring that you include all the essential elements for your business and clients, whether you’re manually creating invoices from scratch or using a HoneyBook invoice template.

1. Business name

To begin, use your business name in the header section of your invoice. If you don’t have a business name yet, simply use your name or the name that’s on your bank account where you’ll receive payments. Including your business name on invoices appears more professional than using your personal name, helping to establish your brand and build trust with clients.

What if I don’t want to use my real name and I don’t have a business name yet?

If your business is unregistered, you can and should still use your business’ given name. The US government allows you to operate an unregistered business under a fictitious name, so long as that name is not legally registered and claimable by anyone else. This is known as your Doing Business As (DBA) name, which you may see as “d/b/a” when you receive payments.

2. Service provider’s (aka seller’s) contact information

When you create invoice documents to send to clients, you’re considered the seller. You should include all of the relevant contact information for your business. At a minimum, this would include your phone number, website, and email address. However, you may also want or need to include a physical mailing address and your social handles.

3. Invoice number

If you DIY your process for how to create an invoice, you’ll need to use an official numbering system. There’s no single way to do this, but you’ll find it makes everyone’s lives easier if you use a numbering system that avoids repeating the same numbers.

Using online invoices will take care of this for you by automatically assigning numbers. The most common numbering systems you’ll find for invoices include sequential systems (1, 2, 3, etc.), or systems that incorporate the year, month, and invoice number for that year. Clientflow management systems like HoneyBook automate this tedious process for you.

4. Invoice date

There’s nothing complicated about how to create an invoice date. Just use the date you plan to send the invoice. Note that this should always be the date you send the invoice, not the invoice creation date you created the invoice.

Related Post

8 invoice examples to bill your clients

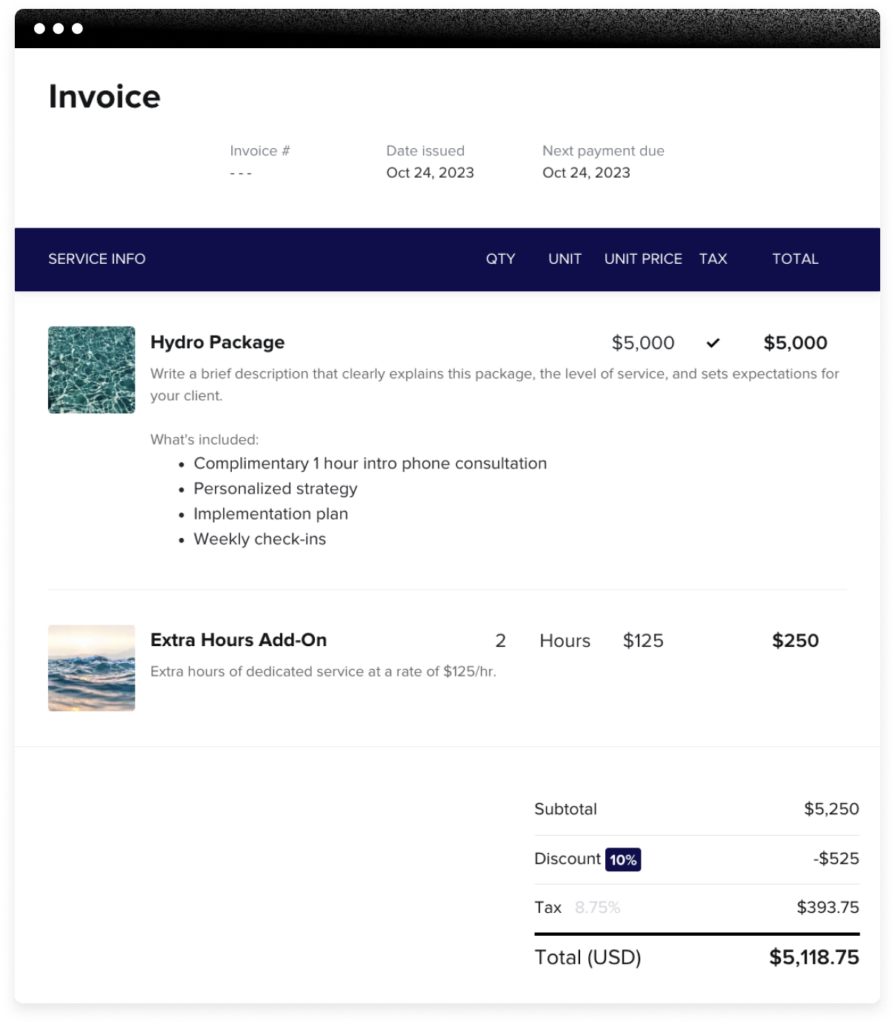

5. Total cost

Provide the total cost of the service you’re invoicing for. Make sure this number is easily visible. Many invoice templates and designs make the total cost among the largest and most easily-identified text on the page.

6. Payment due date

Ensure clients have all the necessary payment details, especially when the payment is due! Make sure the due date is easy to see. Some invoice templates may put the due date right next to the amount due.

If you use HoneyBook, this is especially seamless. HoneyBook invoices send automatic payment reminders so your clients will never be bothered or forget to pay you. They can then pay directly in the platform, and you’re processing payments in one or two clicks with some of the lowest payment fees in the biz.

7. Payment terms

Specify the timeframe within which you expect payment, such as ‘Payment due within 30 days of invoice date.’ Include any late payment fees or interest rates to encourage timely payment. Clearly state acceptable payment methods (e.g., bank transfer, credit card) to avoid any confusion. Including clear payment terms helps maintain a professional relationship with your clients and ensures you get paid for your services promptly.

8. Payment schedule

Outline the frequency and amounts of payments, especially for projects with multiple stages or milestones. For example, you might require a deposit upfront, followed by progress payments at specific project milestones, and a final payment upon completion. Clearly defining a payment schedule helps manage cash flow and sets clear expectations for both parties.

9. Bill to

Your “Bill to” section should include the name and contact details of the individual or business that will be making the payment for the services rendered. Ensure you have the correct name or business entity listed here.

If a business tries to contest payment, having the wrong entity name may make it more difficult to legally defend your right to payment. If you aren’t sure what the “Bill to” name for a client should be, ask the client how to create a professional invoice with the correct entity name.

If someone disputes your payment and you use HoneyBook, our dispute specialists will be at your side making sure things get settled—the right way.

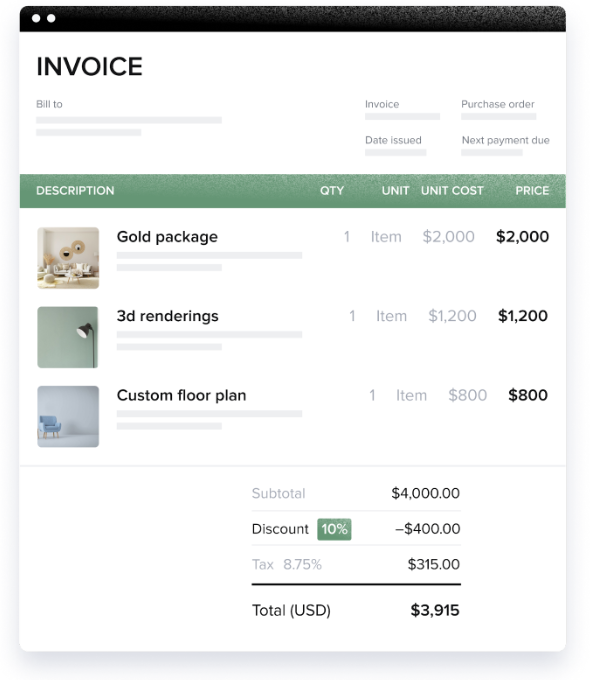

10. Product details and/or service description

You won’t need to spend too much time researching how to create an invoice details section. You have the flexibility and control to provide a detailed itemized list of the product or service you offered or if you prefer, a brief description of the product or service you offered. You should also include the pricing information in the details section, including cost per item or hourly rate, as well as how many items were created and sent or how many hours were worked.

11. Accepted payment methods

Some platforms that allow you to create and send an invoice also serve as integrated payment processors. These services make it easy to accept payments online regardless of which payment methods the client uses; they typically handle the processing for you.

If you do plan to give the client alternative methods of payment, such as credit card, ACH, or bank transfers, list all of the forms of payment you accept. With HoneyBook, you can even request the client “pay now” directly from the invoice. Now that’s easy.

12. Where to pay

Specify the preferred payment method and provide clear instructions on where and how to make the payment. For example, include your bank account details for a bank transfer, a payment link for online transactions, or a physical address for checks. Providing clear payment instructions helps ensure prompt and accurate payments, reducing the likelihood of delays or errors.

13. Terms and conditions

You may want to provide a section that explains the terms and conditions of the service of your service, products, or preferred payment methods. This could include your return or cancellation policy or the penalty for overdue invoices and late payments.

14. Company logo

Add your company logo to instill a sense of confidence in the client that your business is professional. A professional logo is excellent for building your brand and for customer relationships across every type of business, from freelancing to consulting.

15. Discounts and tax

You don’t need discounts or taxes sections on your invoice from scratch if you don’t offer discounts or if you aren’t required to collect taxes for your services. If you do provide discounts, or if you’re legally required to impose a sales or services tax, create a section that identifies the amount incorporated into the final payment due amount.

16. Seller notes

Many invoice templates have a “Notes” section incorporated into them by default. If you’re creating an invoice for your small business, you may want to have a notes section for any details that extend beyond just the service details. It’s a nice place to leave a lighthearted “thank you” note.

What should you not put in an invoice?

When creating an invoice, avoid including personal information such as your social security number and irrelevant personal comments. Stick to the necessary details related to the transaction, such as the services provided, cost, and payment terms. Including personal data can pose security risks, and irrelevant comments can appear unprofessional. Instead, focus on clarity and professionalism by detailing only the essential information your client needs to process the payment. This approach not only protects your privacy but also helps maintain a professional image.

How to format your invoices

Creating invoices isn’t just about sending a request for payment; it’s also about making a professional impression. Here are some things to consider for your invoice design and format.

Invoice formats

- Online vs. offline: Decide whether you’ll create and send invoices electronically or in print.

- Digital signatures: Consider incorporating digital signatures for added security and authenticity.

- PDF invoices: Portable Document Format (PDF) is a widely used format for invoices to clients who want to download or print the document.

- Invoice software: Client management software like HoneyBook allows you to design, create, and send invoices to your client on the same platform you use to sign contracts and schedule appointments.

Invoice design best practices

- Branding elements: Include your company logo, brand colors, and fonts to create a cohesive and visually appealing invoice.

- Consistency: Maintain a consistent design across all your invoices and other business documents. This reinforces your brand and professionalism. HoneyBook offers invoice templates that allow you to customize your invoices with brand elements effortlessly.

- Clarity and readability: Ensure that all information on the invoice is clear and easy to read. Use a clean layout with appropriate spacing.

- Professional language: Use professional language and tone in your invoice, conveying a sense of competence and reliability.

Pro tip

Try designing an invoice with HoneyBook’s free invoice generator and see how easy and fun it can be to create a professional-looking invoice design in no time.

How to send an invoice

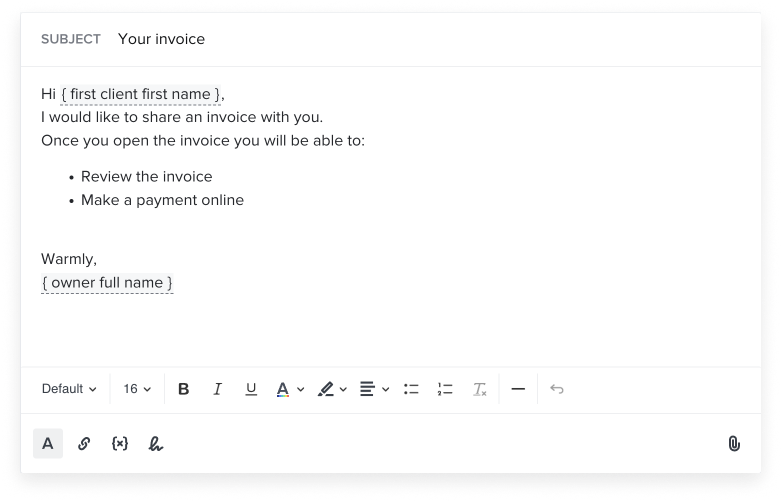

Once you’ve created your professional invoice, the next step is delivering it to your client. Here are some ways of sending an invoice to your clients:

- Email: You can send an invoice directly to your clients via email by converting them into PDFs.

- Print and mail: If your client prefers a physical copy, you can print an invoice and snail mail it to them.

- Invoicing software: Software like HoneyBook allows you to design, create, and send invoices. You can even get paid directly through HoneyBook.

- Online payment portals: Online invoicing and payment platforms like PayPal or Stripe also let you request and collect payments.

Time is the key here. Prompt delivery increases the chances of timely payments and helps you maintain a positive relationship with your clients.

Key elements of an effective invoice

Creating a professional and effective invoice involves more than just listing services and costs. Using an online invoicing platform like HoneyBook can help you streamline the process. When creating an invoice with HoneyBook or making your own invoice, be sure to include as many of these essential elements as possible:

- Include your business name: Ensure your business name is prominently displayed.

- Provide contact information: Add your address, phone number, and email.

- Assign an invoice number: Use unique, sequential numbers for each invoice.

- Date the invoice: Clearly state the invoice date for reference.

- State the total cost: Provide the total amount due for the services or products.

- Specify payment due date: Clearly mention when the payment is expected.

- Define payment terms: Outline terms like late fees or early payment discounts.

- Detail the payment schedule: If applicable, break down the payment amounts and dates.

- Bill to information: Include the buyer’s name and contact details.

- Describe the services or products: Offer clear descriptions of what was provided.

- List accepted payment methods: Mention all acceptable forms of payment.

- Provide payment instructions: Tell clients where and how to make payments.

- Include terms and conditions: Outline any relevant policies or conditions.

- Add your company logo: Enhance professionalism with your logo.

- Optional details: Include notes, discounts, and taxes if applicable.

Level up your business and get paid faster

Invoicing and getting paid is a crucial part of your business, but it’s just one step within your broader clientflow. To get paid as fast as possible, it’s best to ensure you can manage everything in one place, from invoicing to onboarding, project management, scheduling, and more.

Consider a clientflow platform like HoneyBook, which goes beyond invoicing to ensure you can manage your entire business and client relationship.

With a single, robust tool, you can save time and money and create more professional touchpoints with clients.

Offer multiple payment options with HoneyBook and get paid directly through your invoices.