Learn how HoneyBook vs. QuickBooks compare and how you should use each platform.

HoneyBook and QuickBooks are often compared, but which one is better for business owners? At the end of the day, they provide some of the same things, but their strong suits differ. While HoneyBook is great for all-in-one business and client management, QuickBooks is better for accounting.

Explore below to see what each platform provides in terms of reporting, invoicing, payments, project management, and more. The great news is that you don’t have to choose– QuickBooks actually seamlessly integrates with HoneyBook, so it is possible to use both platforms at once.

Jump to:

- Reporting

- Invoicing

- Payments

- Scheduling

- Lead management

- Contracts

- Templates

- Client communication

- Mobile app

- Integrations

- Customer support

- Pricing

- Summary

Reporting

Who wins out?

It’s a toss-up; QuickBooks is an industry leader in accounting software and financial reporting, while HoneyBook will give you more reports around your business activity and conversions.

HoneyBook

HoneyBook offers several reports to provide insights on things like:

- Monthly bookings

- Booking rate

- Collected payments

- Outstanding payments

- Refunded payments

- Lead sources

At the end of the day, it’s not an accounting software, but I do integrate with QuickBooks to get more information on my finances for tax season. HoneyBook’s reports are broad and relate to more business aspects than finances (like lead sources), but it could be more helpful to have greater customization.

Though you can select a specific time frame to view each report, it is a bit limiting that you can’t customize any of the reports.

Premium HoneyBook users can also access team member and client reports.

QuickBooks

Starting with the good side of QuickBooks reports: It provides all the financial reporting that most small businesses need. For example, you can pull profit and loss statements, income statements, and other financial reports that show you how your company is progressing. You can even build a balance sheet and cash flow statement. And those reports are generally easy to read and understand.

But, QuickBooks is an accounting platform at its core, not a CRM or project management tool. While it offers project management features, there’s no reporting outside of the financial reports it provides, even when using the highest tier of service.

The good news is that where QuickBooks is lacking, it often offers integrations to fill the void. That’s the case when it comes to reporting. You can expand upon the company’s available reports by integrating your favorite reporting platform or CRM.

Invoicing

Who wins out?

Both platforms offer a lot of the same invoicing capabilities, but HoneyBook has greater customization with its templates. You can incorporate more of your brand and connect your invoices with other actions as well, like scheduling and contract signing.

HoneyBook

As soon as you create a HoneyBook account, you have access to invoice templates that are easy to customize and use–whether you need a general invoice or a version that’s built specifically for your company type.

Like HoneyBook’s other templates, you can edit your invoice templates or build from scratch using a drag-and-drop editor that supports text, video, and images. I was able to easily incorporate my company brand to make sure my invoices were personalized.

The best part about HoneyBook invoices is the ability to include other actions, like service selection, contract signing, file upload, questionnaires, and scheduling. With every invoice, HoneyBook includes integrated payment processing, so your clients don’t have to jump into another service to pay.

For instance, I can use an all-in-one booking file that includes my meeting scheduler, an invoice for the session, a contract, and payment processing.

QuickBooks

Invoicing is one of the areas where QuickBooks Online shines.

The platform offers basic invoice templates that you can use on an as-is basis, or you can customize them to fit your needs. If you decide to customize your invoices, you can change themes, colors, fonts, and more to align your invoices with your brand image. And your customers can pay your invoices as soon as they receive them with built-in online payments.

Not to mention, QuickBooks offers all the invoicing features you might need. You can set up recurring invoices for customers you charge regularly, take advantage of automatic invoice reminders, and benefit from milestone payments and other custom payment.

Payments

Who wins out?

It’s a toss up; both companies offer a variety of payment processing options. QuickBooks has slightly lower transaction fees, but HoneyBook gives you the option to combine payment processing with other actions, like scheduling and booking.

HoneyBook

With integrated payment processing in your invoice templates, HoneyBook makes it faster for you to get paid. In fact, 90% of HoneyBook invoices get paid on time.

Through HoneyBook, I accept credit card and ACH payments and enjoy some of the lowest transaction fees in the industry, starting at 2.9% + 25¢ for cardholder-entered payments. For reference, PayPal’s cardholder entered fees start at 2.99% + 49¢.

While the integrated payments are helpful for me, I could see that some may not like the inability to choose their own payment processor.

One thing I really love about HoneyBook is that you don’t have to chase payments. You can turn on automatic payment reminders and autopay, along with late payment fees for clients who pay past their due dates.

For greater organization, HoneyBook also enables you to track payment statuses in one place. Plus, view your profit and loss and get greater accounting insights with a seamless integration to QuickBooks.

QuickBooks

Payments are another area where QuickBooks shines. The company offers automatically integrated payments. That means that when you send an invoice to a customer, the customer can click “Pay Now” to pay the invoice online through QuickBooks. And the fees to accept payments are reasonable.

QuickBooks accepts a wide range of payment options like credit cards, ACH payments, and many online wallets. The platform also comes with advanced payment features, like recurring payments and payment plans.

All online payments come with a 2.99% flat fee. If you accept payments in person with a card reader, you’ll pay 2.5% of the transaction. Keyed-in payments come with a 3.5% fee, and ACH bank payments come with a 1% fee that’s capped at $10.

Scheduling

Who wins out?

If you’re looking for the ability to schedule time easily with leads and clients, HoneyBook wins out. QuickBooks doesn’t offer those capabilities, but it is better for big teams where you need to track employee time.

HoneyBook

Inside your account, you can sync your Google, Microsoft, and Apple calendar. Once you integrate, you can see all of your meetings and appointments in one place, plus add team members to view their schedules in your calendar view as well.

With your calendar synced, you can present an accurate view of your availability within the HoneyBook scheduler. Just like other tools like Calendly, you can build specific session types, set your availability for each one, and send them to leads or clients with a link to book time with you.

Instead of going back and forth to find a time that works, clients can select an open time slot on your calendar. Unfortunately, I found it a bit limiting since you can’t offer group scheduling or rescheduling for clients on HoneyBook.

If you also require clients to pay before scheduling with you (say you’re a photographer or a consultant), you can do so with a lead form or a scheduling file template that includes invoice and payment.

QuickBooks

QuickBooks makes it easy to create employee schedules and track employee time. On the other hand, the platform doesn’t offer any meaningful features when it comes to scheduling with your customers. However, you can integrate third-party scheduling tools with the platform.

Lead management

Who wins out?

HoneyBook offers lead capture capabilities and enables you to automate your communications to leads so you can book them faster. QuickBooks does not offer lead management features, only the ability to integrate with them.

HoneyBook

HoneyBook offers two options for capturing leads: a standard contact form and a more robust lead form. Both are customizable, but the HoneyBook contact form is a simple way to capture leads, while lead forms enable you to add additional actions, like scheduling a meeting and paying up front.

You can share both forms on your public channels or privately to capture interested leads. I especially like the fact that you can choose from templates or build from scratch and save multiple forms for different audiences.

Once leads inquire, HoneyBook captures them and adds them to your account and project pipeline. I’ve customized my pipeline to match the steps I use to move leads forward to booking, which makes lead management easier. Plus, I like that you can manage all your communication and files in one project workspace with leads and clients.

Another great feature is HoneyBook automations, which I’ve used to set up instant responses and guide leads through next steps, such as filing out a questionnaire, scheduling time, and booking.

HoneyBook does have it’s limitations with lead management. It doesn’t operate as a traditional CRM where you can score leads or nurture them and access other sales features like marketing automation. In my use, I think its lead management is great for independent businesses that don’t have a large volume of leads.

QuickBooks

QuickBooks has lead management features, but those features leave much to be desired. Unfortunately, the platform only offers features for tracking leads once you have them. There are no advanced features for lead capture, and the tracking features it does have are limited.

QuickBooks’ lead management features are so limited that the company refers its customers to a CRM that can be integrated with its platform for these types of tools.

Contracts

Who wins out?

HoneyBook offers a wide variety of contract templates for all types of businesses and uses cases, while QuickBooks does not.

HoneyBook

HoneyBook offers attorney-reviewed contract templates that you can immediately update with your own information and start using with clients. Whether you need a general contract or a specific agreement (liability waiver, proof sign-off, model release, NDA, etc.), HoneyBook has several options to choose from.

As always, I was still able to start from scratch and drop in my own specific legalese that I wanted to use, but the templates are a really great start.

The contract templates include smart fields, which allowed me to dynamically populate client and project information, like client name, project name, and project date. I saw that you can also pull in information that you’ve set for your company, such as payment late fees and your company information.

I love that HoneyBook contract templates are accessible via desktop or mobile, allowing your clients to eSign from any device.

QuickBooks

QuickBooks is very limited in terms of contracts. Since it’s designed for accounting, invoicing, and payments, it doesn’t offer any contract templates or any meaningful contract features. Instead, you’ll need to take advantage of another tool or use integrations to combine another tool with the QuickBooks platform if you want to create and manage contracts while using QuickBooks.

Templates

Who wins out?

QuickBooks only offers invoice templates, while HoneyBook lets members choose from templates for invoices, contracts, questionnaires, proposals, and more.

HoneyBook

File templates are one of HoneyBook’s strong suits. With an account, you already have a great starting point for every aspect of your clientflow: the process from capturing and qualifying leads to booking clients, managing projects, and maintaining relationships.

You can access all of the following templates, plus build your own:

- Lead forms

- Questionnaires

- Invoices

- Contracts

- Proposals

- Pricing and services guides

- Sales brochures

- Scheduling forms

- Welcome packets

- Project closure files

HoneyBook’s template gallery also offers a variety of templates that are specific to different industries, and are designed by business owners themselves.

QuickBooks

The only real templates QuickBooks provides are invoice templates. Unfortunately, the platform falls short in terms of contract templates, lead form templates, and more.

Client communication

Who wins out?

HoneyBook lets you manage your entire process with clients by aggregating your communications in one place and providing opportunities for collaboration, like a client portal. QuickBooks does not offer client communication features.

HoneyBook

With HoneyBook, I don’t have to worry about sifting through emails or missing client communication. You can integrate any email provider with your account so you’re able to see client emails inside your workspaces. The only downside is that you have to start an email thread in your HoneyBook account, so it won’t pull in all of your emails in your inbox.

From there, you can leverage HoneyBook email templates to save time, set up automated emails at key moments (like after a lead inquires), and even use HoneyBook’s AI Composer to quickly send messages to leads and clients that fit your tone and voice. I personally love setting up email automations for my inquiries to make sure I respond quickly and save time providing information to them.

Though I didn’t set one up, you also have the opportunity to create a branded client portal that clients can use to view communications and files in one place.

QuickBooks

QuickBooks does offer some client communication features, but those features are limited. In particular, you can sync Gmail and other email providers with the platform so the reply-to email address associated with your invoices and other communications is your own.

Unfortunately, however, that’s where the platform’s communication features end. QuickBooks doesn’t offer any portals that make it possible to send unique messages to clients, and the only automated contact you can set up is related to payments, such as reminders.

Mobile app

Who wins out?

It’s a toss-up; QuickBooks’ app is more of a direct comparison to its desktop site for true work on the go, while HoneyBook offers more features overall in its app.

HoneyBook

Within the HoneyBook mobile app, you can view your project pipeline to see statuses at a glance, plus view and edit your task list. You’re also able to manage your calendar and share your scheduler link along with other client communication, like sending and editing files.

Though you can customize your notifications, you have the option to get notified when you have a new message, when a client views a file, when someone signs a contract or pays an invoice, and when you have a task coming up.

Another great feature of the mobile app is time tracking. If you price your services by the hour, the time tracker enables you to stay on top of your working hours, then easily create an invoice directly from your tracked time.

Though the app is robust, I find it to be more of a companion to the desktop site since it doesn’t offer all of the same capabilities.

QuickBooks

Everything happens on the go these days, and it’s important that the tools you use for your business offer mobile capabilities. This is one area where QuickBooks doesn’t disappoint.

The platform offers a highly intuitive mobile app that you can use on Apple and Android devices. In fact, I wasn’t able to find a single feature that I could access on the desktop app but was unable to access on the mobile version of the platform.

In my experience, the platform’s features were just as easy to find and use on the mobile platform as they were on the desktop version. And some features are even easier to take advantage of on the mobile app.

For example, receipt tracking is easier on the mobile app because you can simply snap a picture of the receipt and add it to your books, rather than having to download the receipt from an email and upload it to the QuickBooks platform, as would be the case if you used the desktop version for receipt tracking.

Integrations

Who wins out?

QuickBooks offers more than 750 integrations, making it a good option to use with all of your other business platforms.

HoneyBook

HoneyBook offers the following integrations:

- Email and calendar (multiple platforms): Integrate your Gmail, Outlook, iCloud, or other email provider to centralize your client communication and calendar.

- QuickBooks: Sync your income information from HoneyBook into QuickBooks for more comprehensive online accounting (only one-way sync from HoneyBook to QuickBooks).

- Calendly: Integrate with Calendly to sync Calendly meetings onto your HoneyBook calendar or pull information from your HoneyBook calendar into Calendly.

- Facebook: Integrate with Facebook Lead Ads so you can populate your new leads directly into HoneyBook.

- Pic-Time: If you’re a photographer, you can use the Pic-Time integration to create new galleries, connect existing ones, and see the status of connected galleries all from HoneyBook.

- Zapier: Use Zapier to automate more with your favorite tools, like Trello, Asana, Clickup, Google Drive, and more.

QuickBooks

As mentioned above, QuickBooks is an accounting, invoicing, and payment platform at its core. While that may be good news if you need an all-around accounting tool for your business, it may not be enough if you’re looking for an end-to-end solution for managing your company, its finances, its customers, its leads, and its ongoing projects.

Where QuickBooks lacks, it typically makes up the difference through integrations. The platform is set up to be integrated with over 750 other business apps, making it possible to customize it to your needs.

For example, if you’d rather use PayPal or Square to accept payments than use QuickBooks’ in-house payment services, you can do so through integrations.

You can also integrate your sales channels like Amazon, Shopify, and eBay. By doing so, you’ll alleviate the need to manually input sales data on a regular basis. There are also integrations like Gusto for payroll management, MethodCRM for customer relationship management, and BuilderTrend for project estimates and more.

Customer support

Who wins out?

HoneyBook has more customer support options, including file setup, dispute resolution, and more self-serve learning.

HoneyBook

When you’re first getting started with HoneyBook you can access their free file setup service, which migrates existing files like your pricing lists, contract language, client questionnaires, and more. Within 72 hours, you’ll have your templates successfully added to your HoneyBook account, all without lifting a finger.

HoneyBook offers live chat and email support seven days a week from 7 a.m. to 7 p.m. PT, along with an AI chat resource that can help answer questions easily and quickly.

You can also leverage HoneyBook’s self-service resources like its Help Center and live and on-demand webinars.

A great benefit of HoneyBook is that it offers one-on-one dispute resolution, so you’re in good hands if you’re faced with a client chargeback. If you receive a dispute, a HoneyBook Dispute Specialist will work with you to collect evidence and respond to your band on your behalf.

HoneyBook doesn’t offer any phone support, except for billing issues and dispute resolution.

QuickBooks

QuickBooks customer support is available Monday through Friday from 6:00 AM to 6:00 PM and Saturday from 6:00 AM to 3:00 PM Pacific Time. However, if you pay for the company’s top-tier service, it comes with 24/7 customer support. And if you were to ask QuickBooks, they would likely say that their support teams are highly trained and ready to answer your questions when you need them.

But that wasn’t my experience.

I used QuickBooks in my business for multiple years. And while I didn’t need to contact customer support often, I wasn’t pleased with the support I received when I did. It seemed as though I was constantly given the runaround and met with more questions than answers. In fact, the lack of quality customer support is the reason I no longer use QuickBooks in my business.

And looking into online reviews, I’m not the only small business owner who seems to have had problems with QuickBooks customer support. A common complaint is that it seems as though QuickBooks hires remote customer support staff and provides little to no formal training. Unfortunately, the support team doesn’t seem to understand the details of the platform’s features or even the basics of small business finances and taxes.

Pricing

Who wins out?

HoneyBook overall has a wider variety of features for less per month.

HoneyBook

Free 7-day trial, then the following packages:

| Starter | Essentials | Premium |

| $29/mo billed annually | $49/mo billed annually | $109/mo billed annually |

| – Unlimited clients and projects – Invoices and payments – Proposals and contracts – Calendar – All professional templates – Client portal – Basic reports | – Scheduler – Automations – QuickBooks Online integration – Up to 2 team members – Expense management – Profit and loss – Remove Powered by HoneyBook – Standard reports | – Unlimited team members – Priority support – Multiple companies – Onboarding specialist – Advanced reports |

QuickBooks

QuickBooks offers a 30-day free trial on all of its packages. After the trial, the following pricing applies:

| Simple Start | Essentials | Plus | Advanced |

| $9 per month for the first three months, then $30 per month. | $18 per month for the first three months, then $60 per month. | $27 per month for the first three months, then $90 per month. | $60 per month for the first three months, then $200 per month. |

| – Income and expense tracking – Invoice and payments – Tax deductions – General reports – Receipt tracking – Mileage tracking – Cash flow management – Sales management and tracking – Estimates – Bill pay | Everything from Simple Start and: – Multiple currencies – Up to 3 users – Manually enter time | Everything from Essentials and: – Inventory management – Project profitability tracking and reports – Financial planning tools | Everything from Plus and: – Auto-track fixed assets – Data sync with Excel – Employee expenses – Batch invoices and expenses – Custom access controls – Workflow automation – Data restoration – 24/7 support – Revenue recognition |

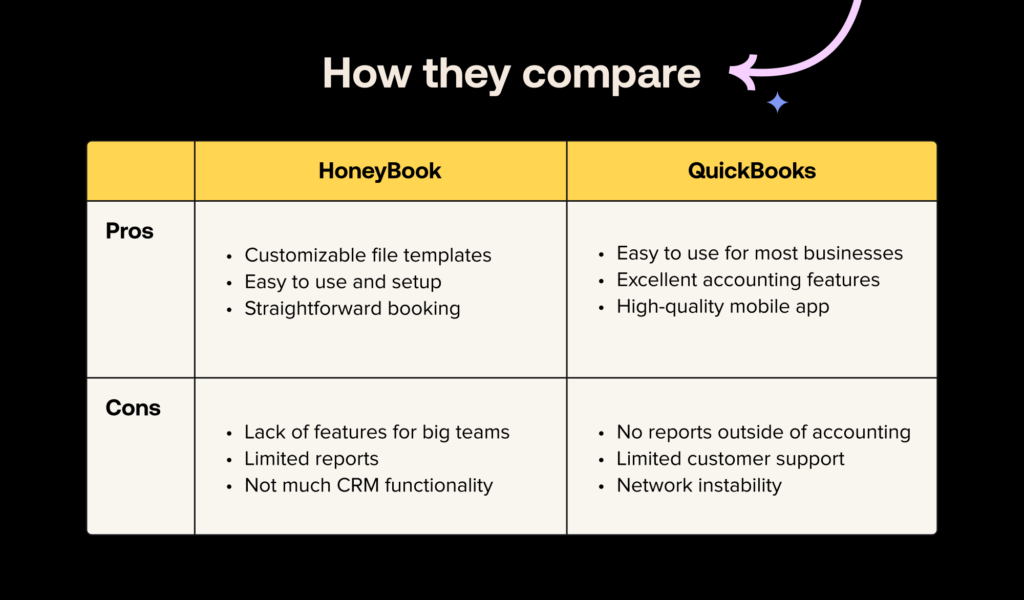

Summary

HoneyBook offers much more capabilities than QuickBooks when it comes to business management. If you’re looking for a good all-in-one solution and fewer software subscriptions, it’s the clear winner.

However, HoneyBook does have as comprehensive accounting capabilities as QuickBooks, and that’s where it can be a good idea to keep both and take advantage of the QuickBooks integration into HoneyBook.

With the integration set up, all of your payments from HoneyBook will be synced automatically into QuickBooks, which you can then use as your go-to accounting platform.

| HoneyBook | QuickBooks | |

| Pros | – Highly customizable file templates for every step of your clientflow – Designed for ease of use and simple setup (file migration included) – Strong booking features for invoicing, contracts, and payments along with scheduling | – Easy to use for most business types – The platform makes finding and fixing errors in accounting simple – A high-quality mobile app makes accounting easy from anywhere with internet access |

| Cons | – Lack of robust features for big teams – Limited branding within scheduling feature – Not much traditional CRM functionality for sales or lead nurturing | – No reports or tools outside of accounting – Customer support is limited and seems to lack product knowledge – Network instability leads to occasional outages |