Conduct a business financial health check by understanding your revenue, expenses, credit, and more. Set yourself up for steady cash flow and long-term growth.

As you begin to pursue your goals this year, make sure you’re keeping your profits in the green by setting aside some time to conduct a business financial health check. When you understand the ins and outs of your financial performance, you can be more strategic about reaching your business goals. Making sure you have a long-term plan for the well-being of your business can set you up for financial success.

To determine if your business is financially healthy, you should take a look at your revenue, expenses, business credit, and investments. Assess how your money is coming in and out as well as how you’re using it. This will help you determine the types of clients you should take on, your ideal pricing structure, and what resources you need this year.

If you haven’t already, prepare for your financial review by pulling these five year-end reports.

Evaluate your operating expenses

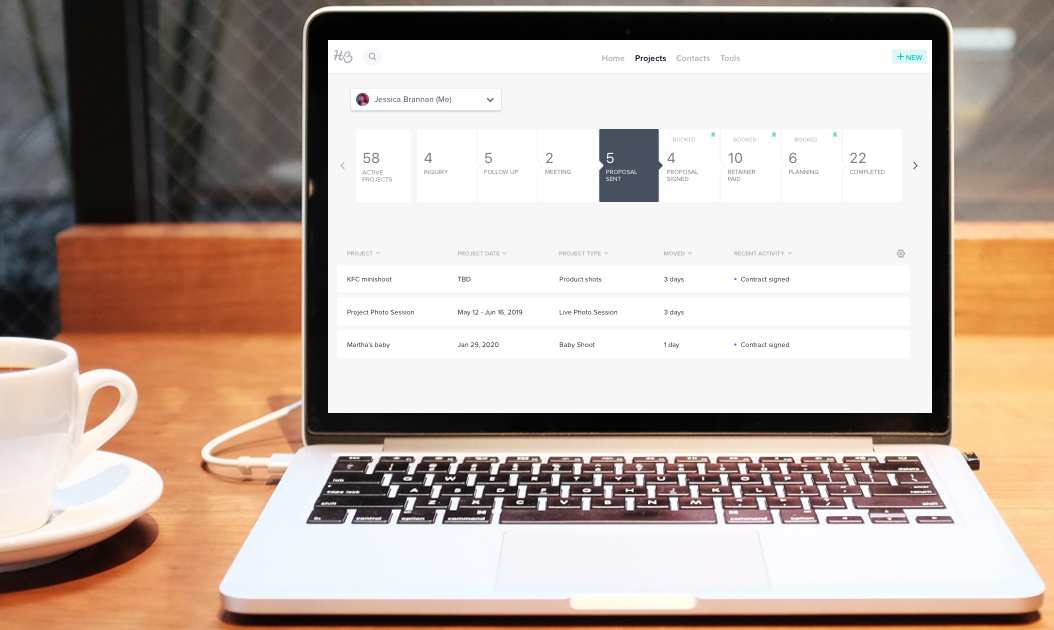

First, evaluate your business expenses. If you use an integrated CRM for small businesses, you should already have all your costs tracked. Using an all-in-one solution like HoneyBook integrated with QuickBooks, you can view your expenses and revenue all in one place.

Once you pull your expense report, audit the full list for expenses you can cut this year. Think about what you used last year and assess whether everything on this list is really needed. There may be software subscriptions you aren’t using or even larger expenses like office rent.

By completing an audit, you might realize that you’ve been spending money on multiple subscriptions when you could be consolidating with all-in-one solutions. Instead of paying for meeting scheduling tools, an invoicing system, and a time-tracking app, consider migrating all your needs into one streamlined HoneyBook account. By satisfying multiple needs with one tool, you’ll eliminate the need for smaller subscriptions that can really add up.

Once you’ve identified where you’re spending extra money, you can make the choice to get rid of the expenses that you don’t need.

As your business grows, you may have new (or growing) expenses to take on each year that you know you can’t cut. You may be at the point where you’re taking on payroll expenses or payments to contractors. In this digital age, software is essential for growing your business. Make a list of these new items, and items you’ll eventually need for growth, and consider how much you need to raise your prices to accommodate everything.

Don’t be afraid to establish pricing that keeps your business moving forward. If your new expenses are adding value for your clients, they’ll understand why you need to increase pricing and make a few changes.

Get our free pricing strategy guide

Scale your business’s financial health year after year by understanding how to set your prices and increase appropriately.

Get The GuideConsider diversifying your total revenue

After you’ve analyzed your expenses, take a look at your total revenue from the past year. Decreasing expenses and raising prices is one way to work toward greater profits, but you should also consider ways you can diversify your income.

Many independent business owners reach a point where they’re ready to take on bigger projects, which can bring in greater revenue. If you feel like you’re at the point where you can take on new clients, consider your marketing plan and goals this year. Even if you’re just testing new initiatives to start, bringing in new types of clients can help you secure your financial health for years to come.

While you’re going after bigger projects, that doesn’t mean you need to ignore your other clients. Consider clients you’ve had to turn away because of their budget limitations. Look for ways you can service these clients without adding more work to your plate. That creates a win-win situation where you’re also growing your revenue.

Create a-la-carte services, or design digital products that create consistent cash flow. Your a-la-carte services can function as add-ons or small projects for clients who might not have the budget for your full-scope services.

Digitizing your services can also function as passive income. For example, if you’re a business coach you can create paid worksheets or digital courses that clients can pay for and use on their own time.

With greater income coming from a variety of sources as well as fewer expenses, you can raise your bottom line this year.

RELATED POST

Optimize your pipeline and cash flow

Did you know that your current pipeline and client process could be affecting your business’s financial health? If you’re dealing with cancellations, refunds, and late payments, these issues can all affect your cash flow. Payments that come in later than anticipated can disrupt your financial plan each month, while cancellations and refunds can even set you back.

Furthermore, the time it takes to actually book new clients can also strain your cash flow. The bottom line: Inefficient processes throughout your business can disrupt your ability to create consistent revenue. First, check your payment and cancellation policies. If you don’t have a force majeure clause in your contract, you might be subjecting yourself to lost revenue when facing unforeseen events like storms, pandemics, or fires.

You might also need to revisit your policy and process for late payments. Using a system like HoneyBook, you can build automated invoice payment reminders to remind clients who simply forget when a payment is due. Your online contract should also include consequences for late payment, such as fees or project cancellation. Clarity around these important customer expectations can ensure smooth handling and no time wasted.

With Lead Sources and Time to Book reports, you can understand how your booking process also affects your cash flow. Perhaps you generate a ton of leads from Instagram, but you haven’t tried testing Instagram ads at all. By allocating more resources to your most successful channels, you can funnel more leads into your pipeline to become paying clients.

By analyzing Time to Book, you can see if leads are falling off at certain stages in your clientflow or taking a lot of effort for you to nurture. Perhaps you experience a lot of back and forth when it comes to service selection. In this case, developing more helpful brochure templates can help speed up the process.

Once you’re generating more leads and moving them forward faster, you can count on steady, reliable cash flow.

Pro tip: A prospective client’s first impression is the most important moment of your clientflow, which means your website needs to be in tip-top shape.

Create a plan for improving your business credit

Business credit is essential for growth, valuation, business potential, and much more. As part of assessing your financial health, pull a business credit report and determine if improving it should be part of your goals this year.

Increasing your business credit can help with your business value (should you decide to sell your business in the future), as well as your interest rates for interest and loans.

Building your business credit is a lot like building your personal credit–make payments on time, make sure you have an appropriate ratio of use, and consider raising your credit card limit if you can.

Invest in your company’s financial health for the long term

Your business’s financial health is something you’ll be working on for as long as you’re running your business. Though it may ebb and flow, paying attention to everything we’ve mentioned will help you develop strategies for long-term financial success.

As you keep your eye on the future, consider using loans to invest in the tools and resources you need to keep growing your business. Whether it’s new digital products, services, technology, or resources identify what you’ve been wanting to invest in to expand your business.

If you’re a HoneyBook member, consider using HoneyBook Capital to help you get access to the funding you need to move your business forward today. Members who are qualified for our loans receive a custom offer, from which you can choose your preferred amount. Our quick loans are based on bookings in HoneyBook, so you’ll only be offered an amount that you’ll be able to repay.

Take the first step toward a more financially sound future for your business!

Apply for HoneyBook Capital

Qualified members may be eligible for custom loans!

Choose this year to invest in your business, whether you’re looking to take on employees, upgrade your equipment, and much more.

Disclaimer: This blog is intended for informational purposes only, and is not to be used as a replacement for financial advice. Please contact a licensed financial professional for guidance specific to your individual business and circumstances.