Learn the fundamentals behind expense reports and take a look at an expense report example you can use to start tracking yours properly.

Independent business owners don’t need to be told how important it is to track spending, whether expenses are fixed or variable. Whether you’re prepping for a new fiscal year or reviewing an individual project, tracking expenses is key to understanding where your cash is going.

Effective and efficient financial management keeps the lights on as much as excellent service delivery, especially for self-made, self-run businesses.

In the process of balancing your finances, you’ll find that some tools are standard. An expense report is a core financial report for independents.

Here you will learn what the critical expense report is, its uses, and the elements it should contain. It’s a fundamental primer on one of the most important documents that serve as the pillar for excellent business financial management.

Jump to:

- What is an expense report?

- What is an expense report used for?

- What is included in an expense report & how to write it.

What is an expense report?

In a nutshell, an expense report is a document used to track business expenses for reimbursement or budgeting purposes. It may include items such as travel expenses, office supplies, and other day-to-day costs or long-term expenses.

It serves a fundamental and critical function in clearly keeping track of expenses so you can stay within your budget. An expense report also allows you to identify areas where you might be overspending and make adjustments accordingly.

Manual expense sheets are typically built from spreadsheets, but the more complex your business needs, the better it is to rely on more powerful financial reporting solutions. That’s why it’s good to use a platform like QuickBooks, that can help you track expenses easily and puts them into a P&L.

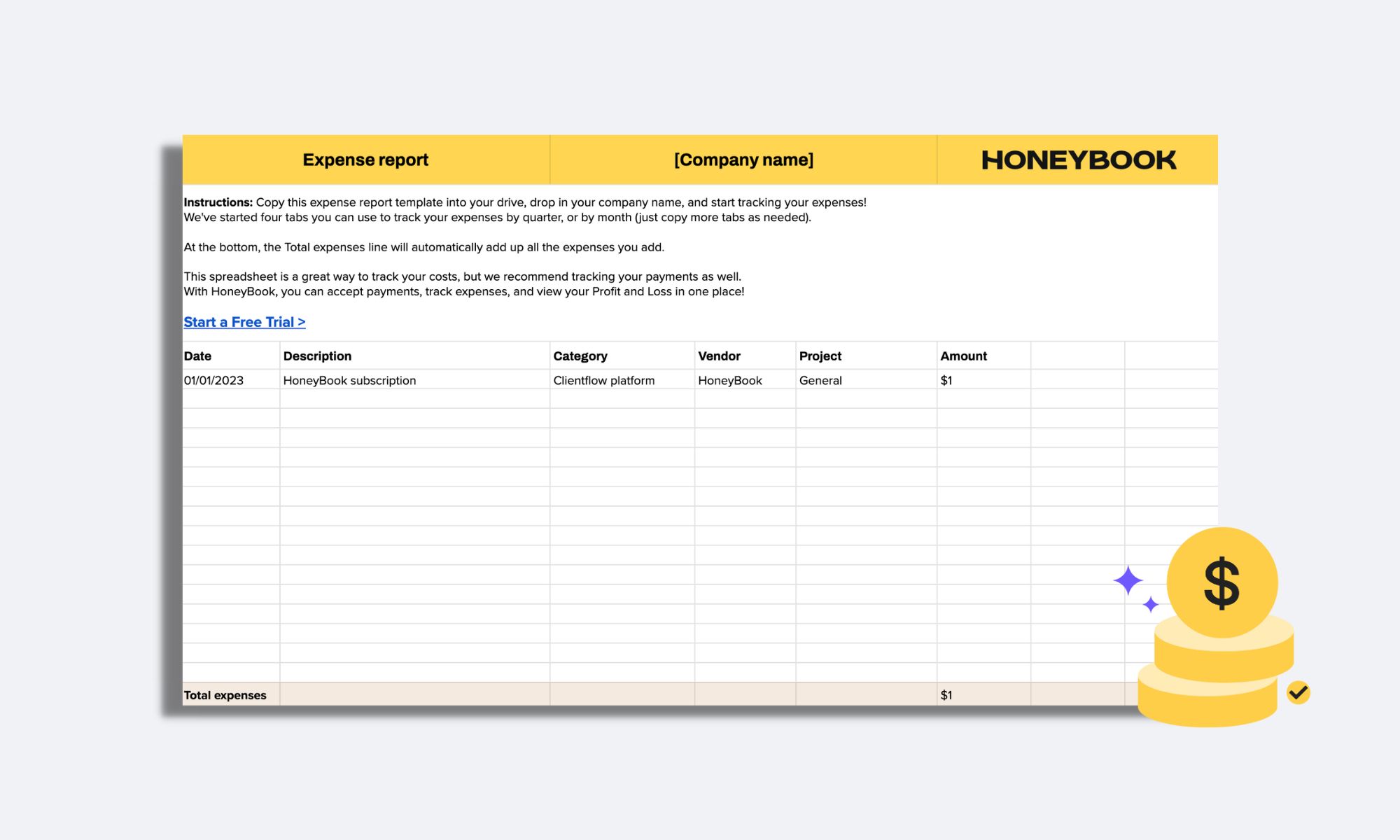

A monthly expense report gives you a quick view of your financial status, and the customizable template below can help you manage both short-term and long-term finances effectively.

What is an expense report used for?

An expense report essentially serves as a reference point for any purpose that involves budgeting and finances. For instance:

Tax purposes and auditing

When you file taxes, expense reports are a requirement for tracking business costs that you can write off. They’re also essential for auditing and other obligatory financial matters, such as reimbursements (and other allowances) for employees.

As your business grows, so too does the importance of a proper expense report, detailing every type of expense. But even if you’re a sole proprietor, your expense report is required for tax filing and auditing. And it is highly important to make sure any documents used for those purposes are filed accordingly.

Cash flow adjustments

Even if you don’t need to file taxes and provide documentation for auditing, you would still need expense reports with itemized expenses to track and manage your cash flow. It’s crucial that you’re able to make data-driven cash flow adjustments by identifying areas where you might be overspending.

You’ll need the historical data contained in previous expense reports to plot future budgets based on your previous spending patterns.

To make appropriate decisions, you should properly define your expense categories. For instance, you might find that you’re spending 15% of your operational costs on software. If you can lower those costs to 10%, that’s 5% lower expenses to help balance your cash flow more positively.

Determining service pricing

Generating an expense report allows you to understand where your money is going, and one key area you want to focus on is service overhead. How much does it cost to deliver your services to your clients?

In the same way, an expense report can provide insight that lets you make better-informed decisions regarding cash flow adjustments, it can also show you how to potentially adjust your service pricing based on overhead.

You might be surprised to find there are unexpected costs associated with your services that you didn’t think of initially. Some overhead costs might not be associated with just one service, for example, so it might not be accounted for in any of your service offerings. Keep a sharp eye on where the spending leads and what it’s for.

Pro tip

Develop custom sub-categories unique to your business for better financial analysis capabilities. If you’re a photographer who spends a lot on film, for instance, that can be its own sub-category separate from other operational costs.

What is included in an expense report & how to write it

To create a thorough and effective expense report, it’s important to focus on key elements that ensure both clarity and accuracy. By understanding how to organize your information and knowing what details to include, you can produce a report that accurately tracks your expenses and strengthens the reliability of your financial documentation. Here’s how structure and write your next expense report with confidence:

- Categorize your expenses:

- What to include: Break down your expenses into categories like travel, meals, entertainment, office supplies, business trips, etc.

- Why it matters: Categorization helps you monitor spending and identify areas where costs may be excessive. For example, if you notice frequent high costs in the “Meals” category, you can reassess your spending habits.

- Include accurate dates:

- What to include: Record the exact date each expense was incurred.

- Why it matters: Dates help ensure that expenses fall within the appropriate reporting period. This is crucial for accurate financial records and compliance with company policies. For instance, if your company requires monthly expense reports, all expenses must be within that month.

- Specify costs precisely:

- What to include: Document the exact amount spent on each item or service.

- Why it matters: Accurately tracking costs is essential for staying within budget and ensuring that you get reimbursed for all eligible expenses. This level of detail also helps when auditing your finances or submitting reports for tax purposes.

- Identify the project or client:

- What to include: If the expense is associated with a particular project or client, make sure to note this.

- Why it matters: This specificity allows for better project management and cost tracking. For example, linking expenses to a project helps in assessing the total project cost and profitability. It also facilitates easier expense attribution during audits.

- Provide detailed descriptions:

- What to include: Write a brief but detailed description of each expense, including what it was for and why it was necessary.

- Why it matters: A well-written description provides context, which is especially helpful if the expense is questioned later. For example, instead of simply writing “Lunch,” describe it as “Client lunch meeting to discuss project scope.” This specificity can prevent misunderstandings and ensure all expenses are justified.

- Attach supporting documentation:

- What to include: Attach receipts, invoices, or any other relevant documentation for each expense.

- Why it matters: Supporting documents serve as proof of the expense and are necessary for reimbursement and tax purposes. For instance, if you claim a travel expense, including a receipt from the airline solidifies your claim.

- Calculate and summarize totals:

- What to include: Add up all expenses and provide a clear total at the end of the report.

- Why it matters: Summarizing totals makes it easy to see the overall spend and ensures that the report is balanced. This step also helps in quickly identifying any discrepancies in the totals versus individual expense entries.

- Review and double-check for accuracy:

- What to include: Before submitting, review all entries for accuracy and completeness.

- Why it matters: A thorough review ensures that there are no errors or omissions, which could delay reimbursement or cause issues during an audit. Accuracy here also reflects professionalism and attention to detail, which are key in maintaining trust with clients or your employer.

By following these instructions, your expense report will be more comprehensive, making it easier for financial tracking, auditing, and ensuring all expenses are properly managed and reimbursed.

Manage your payments and expenses in one place with HoneyBook

If you’re looking for an easy way to track expenses and manage payments, HoneyBook is a great platform that supplants manual, work-intensive spreadsheets while also providing additional, powerful, DIY business capabilities.

With our payment processing and expense report template features, you can keep tabs on your cash flow, record your finances for tax purposes, and get a better understanding of your overall business health. Plus, there’s a free trial so you can try it out hassle-free.

Track payments and expenses in one place

With HoneyBook’s online payment software, you can book clients, manage projects, and keep an eye on your finances.