As an independent business owner, you’re responsible for safeguarding your business as well as your personal assets. This guide will help you learn the importance of hiring attorneys, using legally compliant contracts, and more tips to legally protect your business.

Learning how to legally protect your business is essential to keeping your business and your assets safe from lawsuits and other issues. This entails understanding your business’s structure, knowing the ins and outs of business contract law, and taking action to minimize risks, such as hiring an attorney, protecting your data and intellectual property, and separating your bank accounts.

It’s always a good idea to consult with a licensed business attorney, but you should understand a few things about legal protections and be proactive for maximum protection, minimal risks, and the peace of mind that comes from knowing your business is safer.

Jump to:

- Use business contracts with every client

- Hire a business attorney

- Protect your business data

- Protect your intellectual property

- Separate your personal and business bank accounts

- Take action today to protect your business

1. Use business contracts with every client

Business contracts protect all parties in a business relationship. They spell out the rights and obligations of each party and can be used to defend against lawsuits or file legal action if necessary. Contracts and the clauses within them can be negotiated before you start a business relationship. Always make sure to use legally compliant contracts and ensure your clients sign them.

Contract wording

Contracts build trust with your clients by employing clear agreements, which demonstrate that you’re a professional and take your business seriously. Contracts are legal documents that include specific wording, which must not be confusing.

The contract should clearly set the expectations between the business owner and the client. They should be written clearly and unambiguously. When writing your own contract, fully outline the scope of your service and any warranties. Include any required terms that apply to your general service or to the specific job being performed for that particular client.

A good contract will protect you if you’re sued, so make sure you include all of the important details and don’t add any guarantees that you can’t fulfill. Even if you write the contact yourself, it’s always a good idea to run your contract by an attorney so they can tell you what to take out, what to leave in, and what additional clauses might be necessary.

Essential parts of a contract

Once you have a strong contract in place, you’ll feel much more confident in your business. Take a look at your current contract and make sure it at least has these provisions:

- Parties entering into the agreement

- Date of event or delivery

- List of goods or services being provided

- Cost and payment deadlines

- Specific deliverables

- Termination or cancellation policy

- Intellectual property provisions

- Refund policy

- What limits of liability do you want to have in place?

- Merger provision—is this the complete agreement?

- Choice of law—if an issue results in litigation, do you want to be limited to your state, or do you care if it’s across the country?

Be sure to use contracts with every client. Some clients may want to negotiate parts of the contract, and that’s perfectly reasonable. Just make sure to leave in the essential parts that will leave you protected.

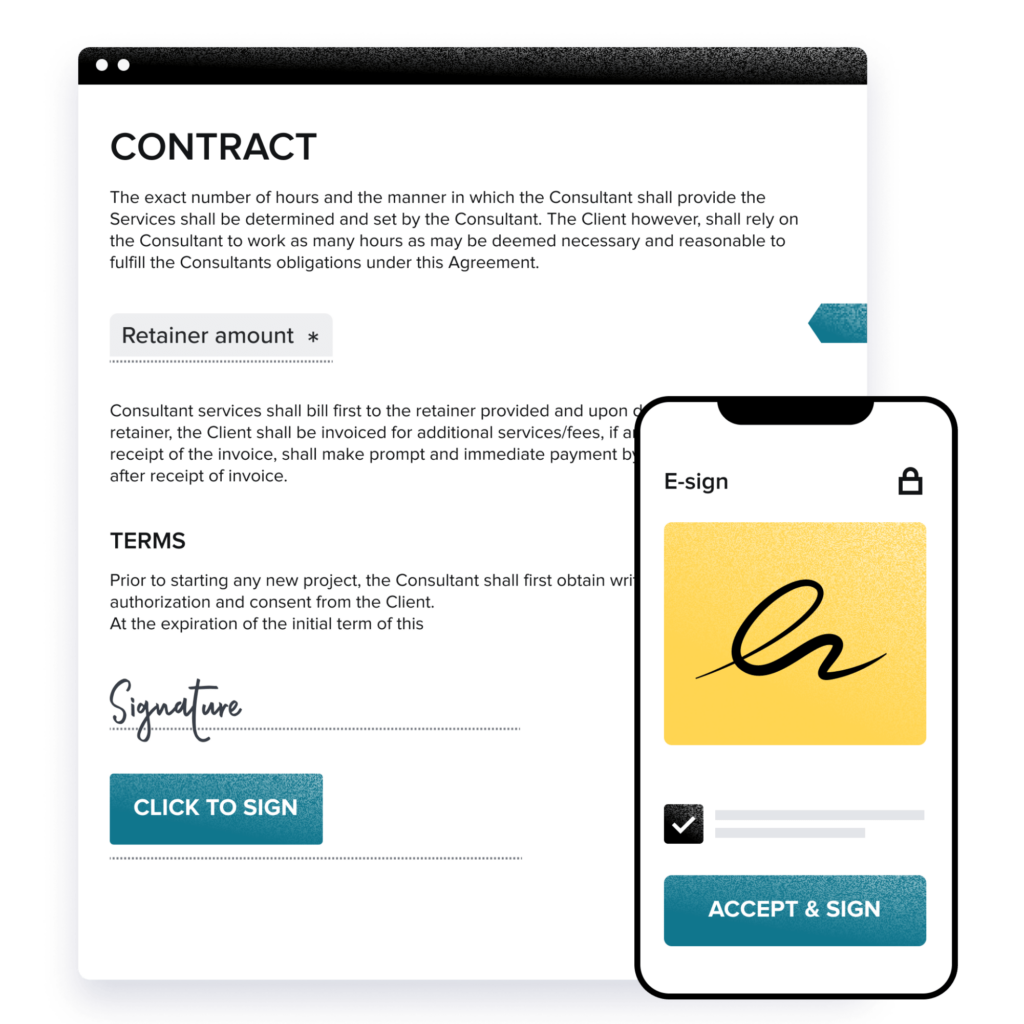

Signing contracts is easy with online contract software. Your client can read the contract online, forward it to their attorney, and sign the contract online without having to print and mail any forms.

To protect your business and secure your peace of mind, use online contracts that can be easily signed by all parties. With HoneyBook’s online contracts, all of the necessary information from both parties is immediately entered into the contract or invoice. Use contract templates to get started or quickly use ready-made legally compliant contracts with new or existing clients.

2. Hire a business attorney

A business attorney specializes in the laws that affect your business operations. A business attorney who’s licensed in your state can help you form your company, write operating agreements, and represent you in court as a plaintiff or defendant.

You may want to consult with business attorneys who are more specialized, depending on your type of business and your specific needs. Business attorneys may specialize in:

- Business contracts

- Business structure

- Intellectual property rights

- Arbitration law

- Property law

- Employment law

You can also hire an attorney to help you in a broader sense or defend you in court if you get sued. Consider hiring an attorney on retainer if you anticipate needing ongoing legal counsel or representation in court.

3. Protect your business data

Cybersecurity is a big part of protecting your business, particularly, though not exclusively, for businesses with an online presence. Your data, as well as your clients’ data, needs to be protected. That entails handling data securely, storing data properly, and complying with data safety laws. Securing your data is also important when you subcontract some of your workload or have to transfer files.

Protecting your business data includes using encryption and secure file transfer protocols, as well as ensuring that all parties handle the data safely. Implementing strategies like doing regular security audits, training employees on cybersecurity best practices, and using multifactor authentication can help reduce the risk of data breaches.

4. Protect your intellectual property

Your intellectual property encompasses intangible assets such as your:

- Trademarks

- Patents

- Copyrights

- Trade secrets

These types of intellectual property can be protected in different ways.

Trademarks

A trademark is an expression, design, symbol, or word used to represent your business. Your trademark could be your business’s name and logo. A trademark could be registered, or its use could be implied. In the United States, trademarks do not expire, and they’re enforceable for as long as the trademark owner uses them and can provide proof of such continued use. If your trademarks are infringed upon, you can take legal action in state or federal court.

Patents

Patents are legal protections for inventions or processes. They offer protection for a certain period, such as 20 years. After they expire, the patented invention or process becomes a part of the public domain. While it’s under protection, you can enforce your patent in civil court if it’s infringed upon.

Copyrights

A copyright is the right to copy text, music, art, or another tangible expression. The copyrighted material does not necessarily need to be registered with the U.S. Patent and Copyright Office, though doing so can offer more protection, such as the ability to sue for statutory damages. Copyrights are valid for a set duration, such as the life of the author plus 70 years.

Copyright protections can be useful even if your business doesn’t involve publishing text or music. If you have a website, the text, images, and videos on the site can be copyrighted. The same is true if you have brochures, advertisements, or videos.

If you find someone infringing on your copyrights, you can send them a cease-and-desist letter demanding that they stop the infringement. If the infringement is online, you can send a Digital Millennium Copyright Act (DMCA) takedown demand to the publisher.

Trade secrets

Trade secrets include your business’s information, methods, and processes that are not open to the public. This could include recipes, closed-source software code, or special techniques that you use to operate your business. These trade secrets may give you a competitive edge, and if a competitor uncovers these secrets, they could unfairly take that competitive edge away from your business.

One risk involving trade secrets is partners, employees, or subcontractors who may use your trade secrets and make them public. To protect yourself against this, you may require non-compete clauses and non-disclosure agreements that would legally prevent these individuals from revealing your secrets or using them to create a competing business for a specified amount of time.

5. Separate your personal and business bank accounts

Separating your personal and business bank accounts is essential for protecting your assets. In the event of a lawsuit, if you mingle your personal finances with your business’s finances, you may have a difficult time explaining to a judge that your funds should not be subject to potential judgments against your business.

One of the risks you may run into as an independent business owner is trouble with the Internal Revenue Service (IRS). This can happen for different reasons, such as making a mistake when filing your taxes or taking deductions for expenses that are not allowed to be deducted. In any case, the IRS may come knocking at your door to audit your business’s finances. Separating your accounts can make your bookkeeping simpler and surviving a tax audit easier.

Take action today to protect your business

Legally protecting your business is an essential safeguard for you and your finances. Continuing to keep all elements of your business safe, such as your intellectual property and your data, should be a continuous process to minimize your risk.

One way to keep your business safe is to use legally compliant contracts. You can do that with software such as HoneyBook, an all-in-one clientflow platform that can help you draft contracts, starting with attorney-reviewed templates, and get your clients to sign them. Overall, it gives you the peace of mind that comes with knowing your business is safe.