What is the best invoice app for small businesses? We evaluated seven baked on ease of use, pricing, and other useful features. Compare and find the right one for your business.

As an independent business owner, you’re going to need some help getting your invoices to clients and getting paid on time. It all comes down to offering a smooth invoicing and payment process. Ideally, you’ll want to find software that can offer features such as invoice templates, auto-pay, payment reminders, payment processing, SMS broadcasting, and a mobile app to use on the go, along with other useful features.

Let’s take a look at seven of the best invoice apps, including HoneyBook, Square, Invoicely, PayPal, Stripe, FreshBooks, and Zoho. Read on for more information to help you find the best invoice software for your business.

Jump to:

- What should go into a professional invoice?

- How to evaluate invoicing software

- HoneyBook

- Square

- Invoicely

- PayPal

- Stripe

- FreshBooks

- Zoho

- Invoicing and payment processing on one platform

Customize, download, and send a professional custom invoice in minutes.

What should go into a professional invoice?

A service invoice is a statement for clients indicating the total payment due for services rendered. It can be for services already provided or for recurring services. Independent businesses can make invoices themselves, or they can use online invoice templates to get started. You can send your invoices as a PDF through email, an online invoicing platform, or an invoicing app.

Invoices should include the following basic elements:

- Invoice number

- Date of services rendered and date of invoice issuance

- Your business name, address, and contact information

- Line item description of services provided

- The total amount owed, plus taxes, if applicable

- Payment instructions

- Payment due date

- Payment terms

- Payment options (credit card, bank transfer, check, etc.) and instructions

Related Post

How to create an invoice and get paid fast

How to evaluate invoicing software and apps

Using the best invoicing software can make sending invoices and collecting payments much easier. The right invoicing software and mobile apps not only make things easier for you, but they also streamline the whole process for your clients. This ensures that you get paid faster and that your business has a reputation for professionalism.

When you’re evaluating a prospective invoice app, consider the following:

- Ease of use: Opt for software that prioritizes user-friendliness. Intuitive interfaces and straightforward features streamline the invoicing process, saving time and minimizing errors.

- Pricing structure: Carefully evaluate the pricing plans of different invoicing apps. Seek transparency with clear, straightforward pricing structures that align with your budget, whether you’re a startup or an established business.

- Additional features: Beyond basic invoicing, consider the supplementary features offered. These may encompass customizable invoice templates, automated payment reminders, mobile accessibility, and support for diverse payment methods. Some software even offers extra features outside invoicing, like project management, client communication, and lead tracking.

- Invoice tracking: Ensure the selected software provides robust invoice tracking capabilities. Real-time updates on invoice statuses, including payment receipts and overdue notices, empower you to stay on top of your financial transactions.

- Payment integration: This isn’t something all invoice software has, but it’s something to keep an eye out for. With payment integration, you can avoid unpaid invoices and get paid more quickly than sending the invoice than prompting your client to pay elsewhere.

Some invoicing software even comes with a customizable invoice generator that allows you to design professional invoices that fit your small business’s brand.

The best invoice apps for small businesses

Choosing the right invoice app is crucial for efficient business operations. In this section, we will break down the top seven invoice apps, highlighting their key features and benefits. These apps are selected based on ease of use, pricing, and additional functionalities, ensuring you find the best solution for sending professional invoices and getting paid quickly. Invoicing software eliminates the longer process of waiting for paper checks by allowing you to send invoices and collect payments in multiple ways. Which invoice app is best for you? Consider the following list as some of the best invoice apps available for small business owners:

- Xero

- HoneyBook

- FreshBooks

- QuickBooks

- Zoho Invoice

- Wave

- Invoice2go

1. HoneyBook

HoneyBook is a clientflow management platform with many features in one platform. Here are some things to consider about HoneyBook:

Ease of use

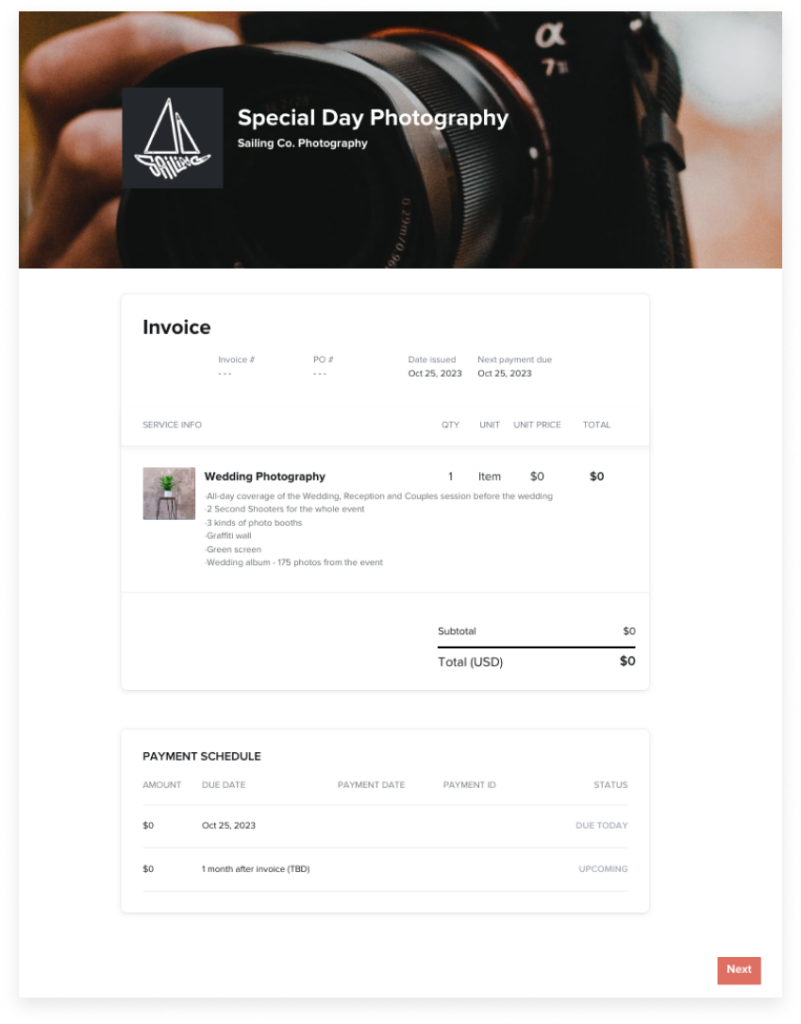

You’ll first notice that HoneyBook is very easy to use. Your account home page offers an all-in-one overview of your business, including inquiries, your calendar, invoice and payment tracking, and notifications of projects with new activity. To create or edit invoices, it also comes with a simple builder that allows you to work in sections and add media like photos and videos.

Pricing

| Starter Package | Essentials Package | Premium Package |

| $29 per month | $49 per month | $109 per month |

| Includes: – Invoices and payments – Unlimited clients and projects – Reports – Automation – Professional templates | Includes: – Starter features – Online registration for QuickBooks – An additional team member – Additional report features – Expense tracking and management | Includes: – All other package features – Priority support – Unlimited team members – Advanced reports (coming soon) |

Get a seven-day free trial to try out HoneyBook and all the great features.

Additional features

One of the things that sets HoneyBook apart is its integrated payment processing. All in one file, clients can view their invoice and pay on the next page. You can also set up recurring payments and automatic reminders so it’s more convenient for everyone. With invoicing and payments in one place, HoneyBook includes some accounting features, like the ability to track profit and loss. You can also integrate with Quickbooks for more comprehensive bookkeeping.

HoneyBook also strives to be the source for managing your client touchpoints by offering you a single communication platform: one place to set payment terms and collect contract signatures, schedule appointments, and automate various workflows. With a HoneyBook account, you’ll also get:

- Lead capture

- Automations

- Scheduling

- Interactive file templates (contracts, proposals, questionnaires, and more)

- Task management

- Time tracking for more accurate billing

- Client communication and client portal

- Mobile app for work on the go

Invoice tracking

Beyond creating and sending invoices, HoneyBook allows you to track the status of outstanding invoices and offer your clients a gentle nudge to remind them to pay on time. You can even turn on late fees, which are included in your reminders and urge clients to pay before the extra fee is added.

Pro tip

Choose an invoicing app that includes integrated payment processing to make receiving payments easier like HoneyBook.

2. Square

Square is one of the most well-known modern payment processing solutions. Here’s a look at what it offers.

Ease of use

Ease of use is considerable, as Square lets you save user profiles and payment methods, but it’s mostly known for serving in-person clients and collecting payments right away rather than invoicing and collecting later. This is great if you work with clients in person but becomes more complicated if you primarily invoice online.

Pricing

| Free Package | Plus Package | Premium Package |

| Free + processing fees | $29+ per month + processing fees | Custom pricing + processing fees |

Square’s pricing structure is a bit more complicated, as it offers hardware that allows you to accept in-person payments, and it’s generally suggested that you set up a hardware POS — point of sale — system if you want to use their invoicing features as well.

Additional features

With Square, the additional features for each of the above packages vary depending on your industry. They can include:

- Advanced POS features

- Retail reports

- Inventory tools

- Automated appointment reminders

- Payment tracking

Invoice tracking

Square allows you to schedule recurring invoices and track payments to help you manage your incoming revenue. It also offers automated reminders to help you collect payment from clients on time.

3. Invoicely

As you can guess based on its name, Invoicely is an invoicing platform for small to medium-sized businesses. It lets you track your time and expenses for services rendered, create beautiful invoices, and like many others, offers a free plan.

Ease of use

Overall, Invoicely is an easy-to-use and straightforward application. Its simplicity makes it a very manageable option for invoicing, payment processing, and expense tracking.

Pricing

| Free Plan | Basic Plan | Professional Plan | Enterprise Plan |

| Free | $9.99 per month | $19.99 per month | $29.99 per month |

| Includes: – Five invoices per month – Three saved clients – Zero additional team members | Includes: – 100 invoices per month – 25 saved clients – Two additional team members | Includes: – 500 invoices per month – 100 saved clients – 10 additional team members | Includes: – Unlimited invoices per month – Unlimited saved clients – 25 additional team members |

Additional features

Invoicely offers the unique added feature of being able to invoice and collect payments in any currency through integrating with larger payment processing companies, such as PayPal. However, it’s not until the upper tiers that you can invoice enough clients to run a business. Other additional features include sending branded estimated quotes and generating summaries of earnings and expenses.

Invoice tracking

Invoicely also offers invoice tracking that allows you to send payment reminders to clients automatically. These automatic payment reminders offer convenience in getting paid on time by letting you set the reminder parameters ahead of time.

4. PayPal

PayPal has been a household name in business for over two decades and is known worldwide. PayPal is so ubiquitous that in 2022, it generated over $27.5 billion in revenue. How did it do that? Fees.

Ease of use

PayPal is generally considered easy to use, but the interface isn’t distinctly amazing at helping you navigate through the platform. Though everything is labeled and pretty straightforward, the platform can be a bit overcrowded.

But, PayPal still lets you create standard invoice PDFs that you can then print or send via email.

Pricing

| Transaction Type | Fees |

| PayPal Checkout | 3.49% + fixed fee |

| PayPal Guest Checkout | 3.49% + fixed fee |

| QR code Transactions | 2.29% + fixed fee |

| Send/Receive Money for Goods and Services | 2.99% |

This is just a snapshot of the extensive fee program PayPal uses. And, if you’re wondering what the additional “fixed fee” for each transaction is, that depends on the currency in which you’re receiving payment.

Additional features

While the constant advertising of their banking products can clutter up the platform, they’re also useful additional features. PayPal offers competitive cashback credit cards for your business and several other financial products that help keep your endeavors funded.

Invoice tracking

PayPal also claims to let you track invoices from anywhere you have an internet or data connection. It also allows you to set up payment reminders on your phone so you don’t have to do extra work to remind clients when they have an outstanding payment due.

5. Stripe

Stripe is a well-reviewed, well-rounded invoicing and payment processing application. It allows businesses to accept payments through various methods, including credit and debit cards, ACH bank transfers, and digital wallets like Apple Pay and Google Pay.

Ease of use

Ease of use with Stripe depends on what you want to accomplish. While the general invoice and payment tools are straight forward, Stripe also gives you the option to fully customize your checkout flow. While this is a great feature, user reviews claim it isn’t easy. Some reviews claim the customization process requires advanced technical knowledge that may include some coding.

Pricing

| Invoicing Starter | Invoicing Plus |

| 0.4% per paid invoice | 0.5% per paid invoice |

| Includes: – Dashboard analytics – Hosted invoice page – Customer portal | Includes: – Starter package features – Smart retries for automatic collection – Email reminders for payment – Auto-reconciliation |

Stripe has one of the most unique fee structures on this list and these fees seem to only cover the invoicing, not the payment collection. For payments, the Dashboard fee structure varies based on the form of payment your clients utilize. For example, The fee changes to 0.8% for ACH transfers and 2.9% + 30 cents per successful charge.

Additional features

Though the Starter package is quite basic, as you get into Stripe’s additional features that you can add, there’s a lot to love, like:

- Real-time reporting

- QuickBooks and Netsuite support

- iOS and Android dashboard apps

- Technical support on Discord

- Acceptance of over 135 currencies

Invoice tracking

Stripe also makes it easy to track the status of an invoice from the invoices page found on the app dashboard. This feature is rather straightforward with Stripe, as it simply provides a list of invoices you’ve created and shows a brief status.

6. FreshBooks

FreshBooks is a comprehensive invoicing and accounting software designed for small businesses and self-employed professionals. Here’s a look at the vitals.

Ease of use

FreshBooks software is reportedly easy to use with an intuitive interface. However, user reviews also report that few customizable options make other applications more accessible to use. Additionally, it’s noted in multiple reviews that the platform is best for freelancers and very small businesses, which could make it challenging to continue using as you grow.

Pricing

| Lite Plan | Plus Plan | Premium Plan | Select Plan |

| $17per month | $30 per month | $55 per month | Custom |

| Includes: – Unlimited invoices to five clients – Run reports of taxes – Expense tracking – Credit card and bank transfer payments | Includes: – Unlimited invoices to 50 clients – Recurring bills and client retainers – Mobile mileage tracking – Business health reports | Includes: – Unlimited invoices to unlimited clients – Automatic expense tracking – Financial and accounting reports – Invitations to your accountant to view your account | Includes: – Unlimited invoices to unlimited clients – All other plan features, plus a selection of additional chosen features |

Additional features

FreshBooks is perfect for adding extensive accounting and reporting features to your invoicing application. At the highest tier, it offers the following additional features:

- Checkout links

- Line items on bills

- A dedicated number for exclusive support

Invoice tracking

FreshBooks invoice tracking lets you see if an invoice you’ve created is:

- In draft

- In progress

- Overdue

- Outstanding

Additionally, FreshBooks allows you to utilize both automated and manual reminders, to ensure your clients know when payments are due.

7. Zoho

Zoho Invoice is a customer relationship management software — CRM — designed to offer free and simple invoicing.

Ease of use

Generally, this application is straightforward and touted in reviews as a great entry-level CRM software. So, though it’s easier to use for beginners, business owners looking to scale their business may find this no longer fits the bill.

Pricing

| Standard | Ultimate | Professional | Enterprise |

| $14 per user each month | $23 per user each month | $40 per user each month | $52 per user each month |

| Includes: – Basic modules – Email insights – Other basic features | Includes: – Macros – Sales signals – Assignment rules | Includes: – Multiple scoring rules – Webform analytics – Data encryption | Includes: – All other level features – Zoho analytics |

Additional features

In addition to the tiered features you see about, Zoho offers the following additional features:

- PayPal and Stripe integrations for payment processing

- Customizable invoice templates

- Additional languages and currencies for invoices

Invoice tracking

Zoho offers invoice tracking that sends automatic reminders to clients with due or overdue payments. While this is helpful as invoices come due, it still requires you to remind clients to pay on time to avoid fees and so that your revenue stream remains consistent.

Invoicing and payment processing in the best invoice app

When choosing your invoicing software, you’re going to want a platform that does more than just send invoices to clients. Luckily, a clientflow platform like HoneyBook can help you with writing legally compliant contracts, using invoice templates, and processing payments from clients.

You can send proposals, schedule meetings, and manage client communications. The platform also allows you to save client details to fill in invoices, making invoicing even quicker. When a client pays, you’ll also be notified in real-time.

Since invoicing and booking are so integral to your clientflow, why not use a platform that’s built for your processes? With HoneyBook, you can combine key actions, so there’s no need for you or your clients to jump back and forth between different software. Communicate with leads and clients, book projects, and manage your work in one place.