As a full-time business owner, the idea of an audit can be daunting, especially if you’ve never done one before. But while the word “audit” sounds like something only accountants do, it’s a lot simpler than that. An annual business audit is simply a formal examination of your company to make sure everything is running smoothly and in accordance with your goals for the year ahead.

The goal of an annual audit isn’t just to find problems but also to identify areas where there are opportunities for improvement and success. In this article, we’ll take a look at five areas you should consider auditing every year so that you can identify the problems that need to be fixed and strengthen the areas that are working. Let’s get started.

Areas Of Your Business To Review In A Yearly Audit

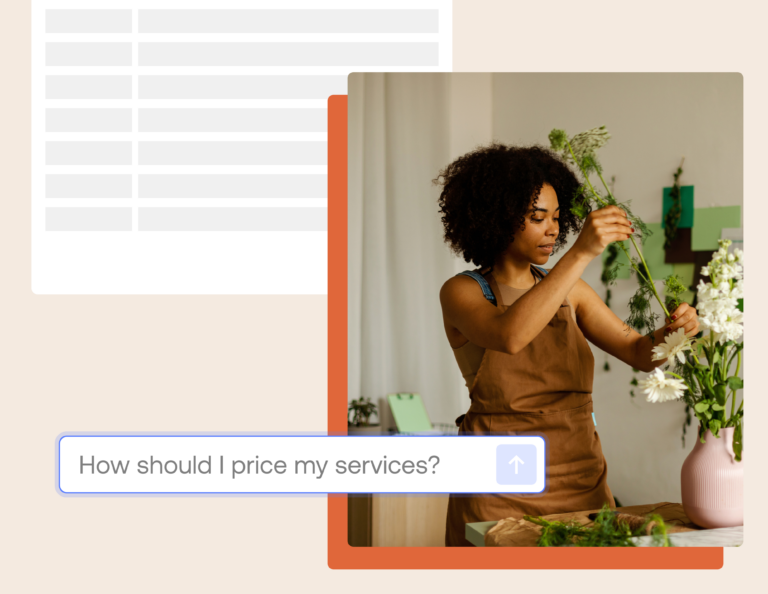

1. Financial

When it comes to financial audits, one of the best ways to get started is by mapping out a year’s worth of income and expenses and then seeing how they lined up with what you had planned. If you make payments using an online payment software in your business, you can use your account records.

If you take cash payments, track how much is coming in on a daily or weekly basis and keep the receipts in an envelope so you have a record of what transactions took place each day.

When it comes to business audits, knowing where your money is going – and how it’s being made – is essential. That’s because if you don’t know what’s generating revenue and what isn’t, you could be wasting time working on something that won’t prove profitable for your company.

Speaking of specific time-wasting, one thing that could help when it comes to getting better results from an audit is to use a timer app for Windows. This will ensure that time is being spent on the tasks that matter and not being wasted on items that are not a top priority.

Image Credit: https://wallstreetmojo.com

Getting back to the importance of a financial audit, let’s say that on a specific week you have 20 orders from customers who spent $100 per item. In another week there were only 5 orders from customers who spent $200 per item.

In the first week, those smaller orders might have covered your costs and were still enough to make a profit. But in the second week, even though you had bigger orders, you didn’t make enough to generate a profit at the end of the day.

In addition, knowing your numbers also helps you plan for the future.

For example, if you’re running low on cash and need to pay your business rent soon but know that only 25% of your customers are making purchases over $200 – while at least 50% is needed to make the numbers make sense – then you’ll have a better idea of what steps you’ll need to take to generate more revenue before it’s time to write the check.

Audit your financials is the key to understanding where you are at in your business.

2. Marketing and Sales

Often referred to as the “front door” of a business, marketing is a way of bringing in new customers while sales help keep existing ones. Marketing focuses on advertising and promoting your brand while sales take care of individual transactions between you and your clients.

To audit your marketing activities, take a look at how much time you’re spending online or offline during the week in marketing and sales-related activities. You can start by recording it in a spreadsheet every day for the next two weeks so that you have information from which to create comparisons. In addition, ask yourself the following questions:

- What am I working towards when it comes to increasing revenue or gaining new customers?

- What might need refinement?

- How is my current strategy working out when compared to my goals?

By answering these questions, you’ll be able to determine whether or not your current marketing efforts are helping you achieve your goals. The great thing about sales and marketing is that you can track your progress with reports and metrics.

By using the right KPI software, you can set up reports regularly so that you have the information you need to figure out what’s working and what isn’t.

For example, you could create a report each month for new customers who signed up over the past 12 months to track which marketing channels are bringing in the most leads. You might even consider creating an email funnel or using online marketing software to monitor how many people are visiting your website, subscribing to your newsletter, etc.

Knowing what the next steps are starts with doing the right type of sales and marketing audit in the first place.

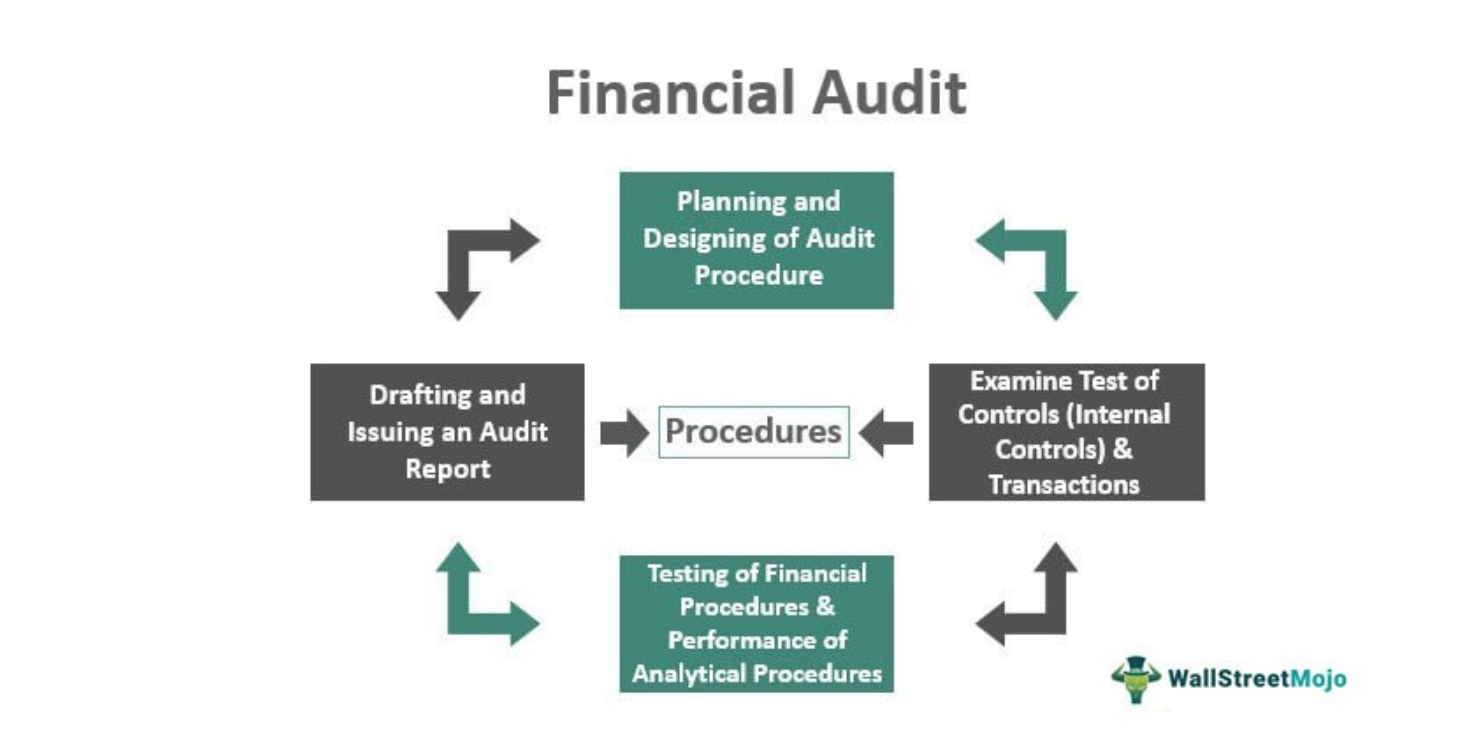

3. Product Development or Quality Control

Sometimes, full-time business owners have great products or services that solve a need in the short run but they fail to focus enough on their long-term quality. As a result, the short-term gains aren’t worth the long-term losses when you consider things like high return rates and missed opportunities for growth.

If product development is an area that needs improvement, consider using technology to audit and track the steps that are being taken to bring a project from start to finish.

Image Credit: https://productfocus.com

On the other hand, if your business relies on certain suppliers or manufacturers, you can still use software solutions to keep track of how many orders have been placed so far, how long it’s taking them to fill those orders and whether or not your customers are happy with the product that they get.

In addition, use this as an opportunity to do some cross-referencing between departments. You could compare the number of calls being made by customers who have submitted complaints against those who have given you glowing reviews.

To measure quality control, you can ask yourself these questions:

- What is the number one problem in my company’s product development process?

- How is this impacting me financially and my customer service efforts?

- What are the steps I can take to solve this problem?

- Where do I need to start?

After finishing an audit, create actionable steps to resolve each problem, then set up a system that allows you to track how to progress and the new results you’re getting.

4. Operations and Logistics

A growing business needs an operations manual that is detailed enough to cover everything from how production schedules are being met, what steps need to be taken if a machine goes down or there’s some other type of emergency, and whether or not the facilities are still running smoothly.

A growing business also needs to have procedures in place for tracking all of these items so that the business owner has all the information necessary to make adjustments as needed. For example, if one supplier isn’t meeting your delivery schedule, it might be time to find another one who can come through on short notice.

By auditing your operations and logistics annually, you can become more efficient and save time before problems arise. You’ll also have a better idea of whether or not employees are being treated fairly and being paid what they deserve for the work that they’re doing, whether or not growth opportunities are being fulfilled and if certain procedures could be streamlined to improve efficiency.

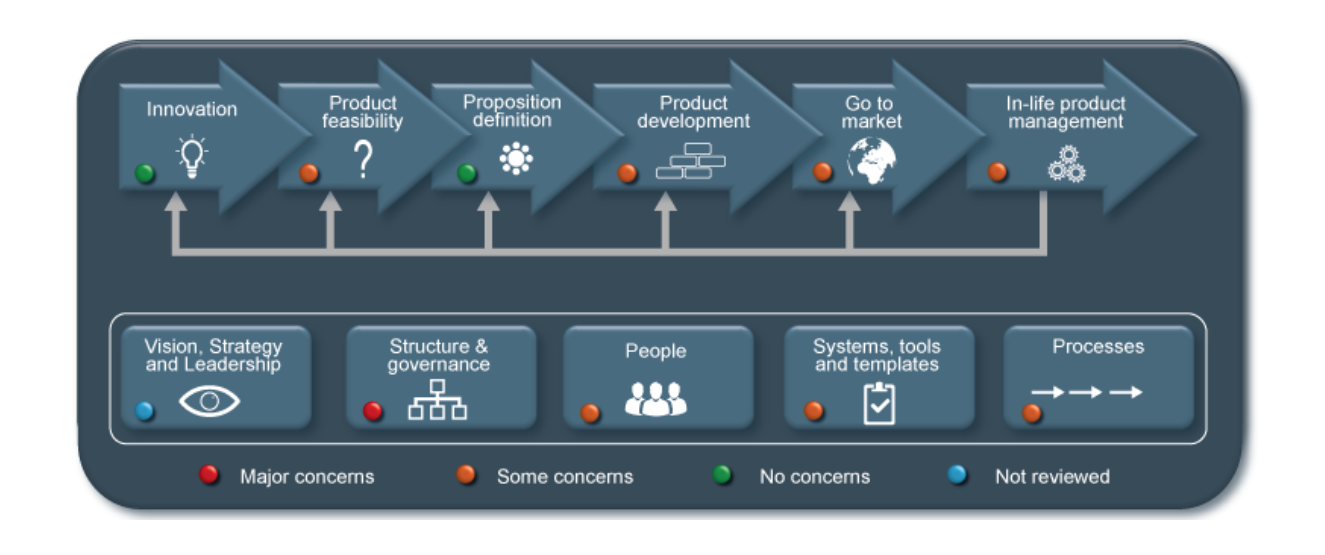

5. Human Resources and Employee Benefits

As a business owner, you’re responsible for making sure that your employees are paid fairly and that all your workers are given access to the same level of benefits.

Before an HR audit, make sure you ask yourself:

- Am I paying my employees what they deserve?

- What data should I be looking at to determine this?

- Do my employees know about all of their benefits (i.e., healthcare or life insurance)?

- If not, is there a way that I can improve this process?

By ensuring that the HR departments set up yearly meetings (you can use a top-notch online meeting scheduler to easily set up meetings that work for everyone’s schedule), then you can measure if employees are satisfied with these benefits.

This will also allow you to communicate with your employees at the level needed for them to feel valued.

Image Credit: https://coremeasures.org

By auditing your HR department or benefits every year, you can figure out which perks would best suit your employees’ needs and whether or not they’re being communicated effectively. You can then use this information to determine how much growth potential there is for both current and prospective employees.

Benefits To Doing An Annual Business Audit

Now that we’ve looked at the various areas you should audit, it’s time to look at some of the benefits of doing a yearly audit.

Management Can Monitor Operations, Identify Key Problems And Suggest Possible Solutions.

- By monitoring operations, problems can be identified and corrected early, thus avoiding larger costs at a later time. In addition, by monitoring activities within their organization, managers can support fast decision-making for effective planning.

- The process of planning is advantageous to the business because it allows them to identify objectives and create strategies. It also helps them identify problems that could detract from achieving those objectives.

- If these issues are addressed before they become major problems, the company will be more likely to meet its goals within set budgets and on time.

- A yearly audit allows management to take stock of what has been done so far in their business plan for the year and see if they are progressing towards meeting original targets or not.

This is crucial in ensuring their vision is still intact at all times and allows them to spot potential issues earlier.

Employees Are More Likely To Comply With Procedures If They Know That You Are Regularly Checking Compliance.

Audit activity helps to keep employees focused on the tasks at hand by identifying areas of potential improvement and letting them know what you expect from them. It also ensures that employees who don’t meet standards or expectations can be addressed while ensuring a group-wide standard of excellence. When employees know what is expected of them, they are better able to work together to achieve the overall goals.

Also, keep in mind that employees that are aware of your business plan are better able to handle their responsibilities more effectively. Knowing what they’re working towards will provide them with a greater awareness of the company’s goals which is a win-win for everyone involved. A yearly audit with employees also helps to improve morale because employees are likely to feel more involved in the company when they know what is expected of them.

The purpose of an audit is to enhance the decision-making process by providing companies with relevant information, which will allow them to make informed choices in their day-to-day tasks.

The Company Can Compare The Current Year’s Performance Against The Previous Year

Using a tool that’s built for small businesses when conducting yearly performance will allow business owners to see how the business year is progressing when compared to previous ones as well as to set targets.

- Companies should compare the previous year’s targets with those for this year, as well as strike comparisons with other companies (and benchmarks) in the industry.

- By comparing the current year’s results to the previous one, companies can determine if they are meeting or exceeding their business goals.

- This comparison can not only provide a stronger understanding of where things stand today but also indicate any improvements or declines from last year.

Conclusion

Audits may not be something that everyone looks forward to; however, if you take steps to make them more manageable, your company will benefit from them for years to come.

Stakeholders should always remember that audits are not just about money; they help to increase efficiency, safeguard resources and focus attention on areas of greatest risk. With a yearly performance review, it is easier to identify problems and minimize their impact as quickly as possible.